Introduction

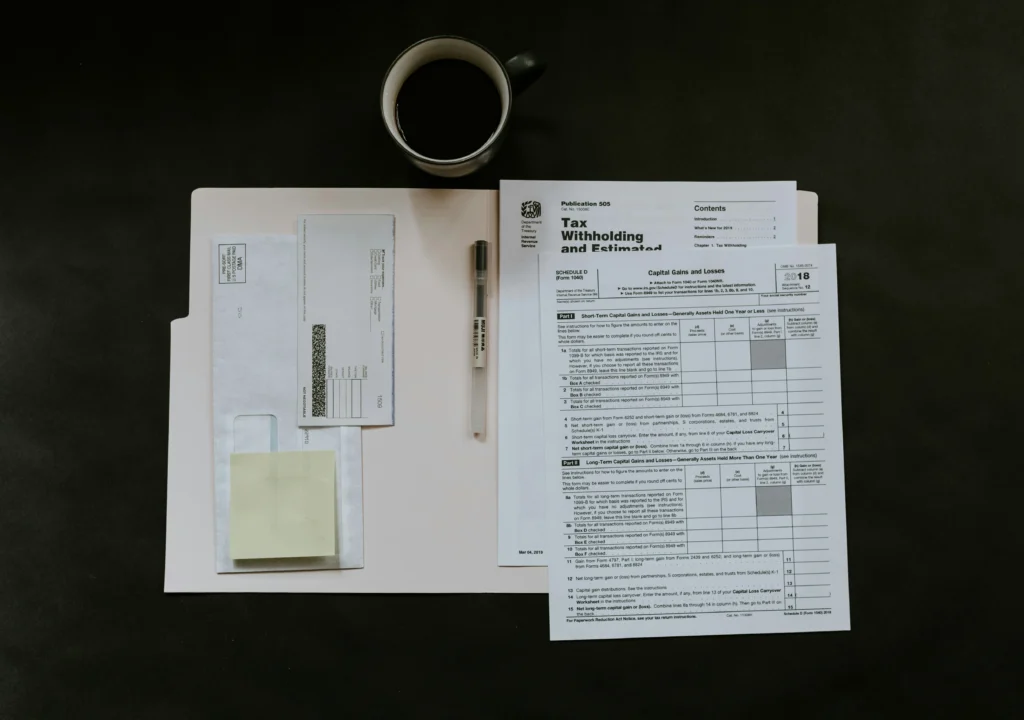

With the end of the financial year approaching, the Ahmedabad Municipal Corporation (AMC) has revised the tax penalties around arrears to encourage more property tax payments. As per the latest update, property taxpayers will now be eligible for a 100 percent interest subsidy if they clear their pending arrears by March 31, 2024. Let’s know the details of property tax in Ahmedabad.

Table of Contents

- Discounts and Rebates by AMC

- Calculate the AMC Property Tax In Ahmedabad

- Ahmedabad Property Tax rates

- How to Pay AMC Tax Online in Ahmedabad?

The property tax rate in Ahmedabad varies depending on the type of property. i.e., whether the property is residential or commercial, and the location of the property. Property tax is generally collected by municipal corporations or local civic bodies in the city. Ahmedabad has become the first city in India to introduce an online property tax payment system.

Discounts and Rebates by AMC

To address the problem of rising property tax evasions and defaults, the AMC has introduced a scheme between February 15 and March 31, 2024. Under this scheme, delinquent taxpayers can now clear their 2023–24 property tax payments at 100 percent. However, the calculation for a concession on interest has to be done based on the new formula.

Flats, apartments, rentals, bungalows, and villas under the old formula can get only a 75 percent concession. 100 percent subsidy remains for slum and Chawl dwellers using the old formula. In the case of commercial property owners, the rebate percentage is limited to 60 percent only.

Calculate the AMC Property Tax In Ahmedabad

In addition to the offline process, the AMC has made provisions to collect property tax online as well through its website and mobile application. Generally, the property tax bill details are calculated according to the carpet area of the property and other factors.

- Type of property (residential/commercial): It includes the occupancy factor rate, government building (yes/no) and water zone (yes/no)

- Location of the property: It encompasses land value, location factor, etc.

- Age of the property: It includes the year of construction of the building, age factor rate, etc.

- Usage of the property: It covers the building group, building type, usable code, and usage type rate.

Ahmedabad Property Tax rates

The latest tax rate in Ahmedabad depends on the type of property. Check out the various rates in the table below.

| Types of Properties | Property Tax Rates |

|---|---|

| Residential property | Rs 16 per sq m |

| Non-residential property | Rs 28 per sq m |

Apart from this, AMC also has the following charges:

| Types of Tax | Property Tax Rates |

|---|---|

| Water Tax | 30-45 percent General Tax |

| Education concession | 10 percent of General Tax |

| Conservancy Tax | 30-45 percent General Tax |

How to Pay AMC Tax Online in Ahmedabad?

- Step 1: Go to the Ahmedabad Municipal Corporation website and click on online services.

- Step 2: Enter ‘Tenement Number’ and click search.

- Step 3: Next, the name of the owner, address, occupier, and the amount due will be displayed. Select the “Pay” button to proceed with the payment.

- Step 4: The user will be redirected to a page that shows a confirmation of the tenement details and payment amount. The same page would contain fields requiring the owner’s mobile number and e-mail address.

- Step 5: Click on the confirm icon to continue the process. The user will be redirected to the payment gateway. The payment can be made via debit card or credit card.

- Step 6: Following the payment, the user will receive a Transaction Reference Number (TRN) as acknowledgment. Payment will be credited to the Municipal Corporation’s account within two working days.

The payment receipt will be available on the Corporation’s website or sent to the property owner’s email address.

How to Assess Property Tax Under AMC?

AMC suggests an option to calculate the appropriate value of tax payable. Payment details will be received by users by selecting ‘Self-Assessment’ under ‘Citizen Services’ and entering the following details.

- Property type

- Tax per cent

- Use Factor (Building Group, Use Code, Building Type and Use Type Rate)

- Land value

- Occupancy Rate (Type of Occupancy, Occupancy Factor Rate, Government Building, Water Zone)

- Occupancy factor details

- Discount price

- Year of construction

- Age factor rate

- Carpet area

- The entire area

Conclusion

Stay updated in the real estate industry by following Openplot. Our platform provides informative articles, news and updates. With reliable and accurate information, it is a destination for everyone who wants to know about the real estate sector.

Also read: Property Tax in Bengaluru Is Going to Go Up Hugely