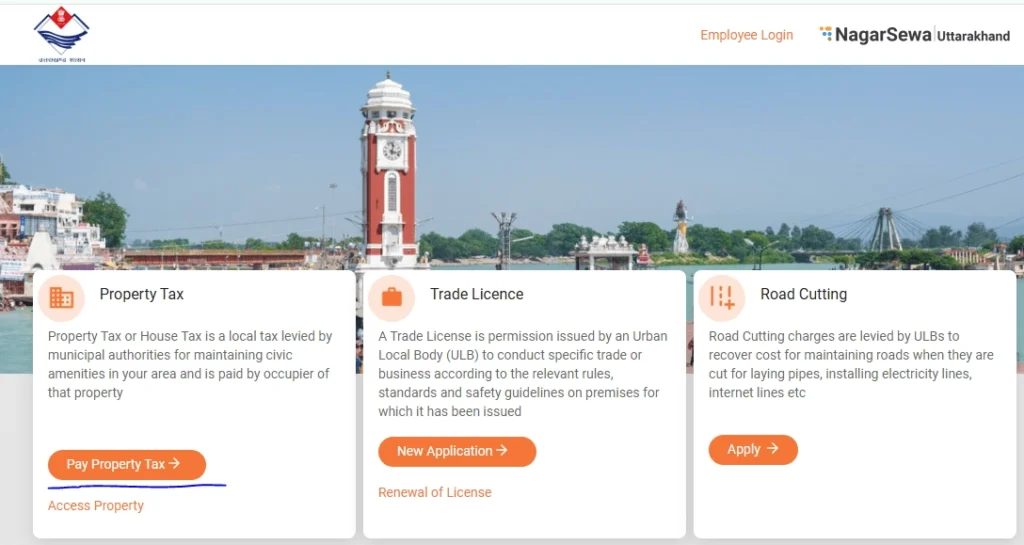

Uttarakhand property tax payment through the Nagarsewa portal is now easier than ever with a user-friendly interface. Let’s learn how to effectively manage property tax obligations with these simple steps. Let’s see how to pay using this portal.

Table of Contents

- Understanding Property Tax

- Property Tax Important

- What is NagarSewa?

- Uttarakhand Property Tax Dues Payment Procedure

- Alternative Methods of Payment for Property Tax

- Advantages of Online Payment Platform for Property Tax

- How to Check Your Property Tax Status Online?

- Calculating Property Tax in Uttarakhand

- Common Problems and How to Resolve Them

- Frequently Asked Questions

This guide offers a comprehensive overview of how to pay Uttarakhand property tax online via NagarSewa, explaining everything from understanding property tax basics, using the online portal, calculating tax, to troubleshooting common issues.

Understanding Property Tax

The Uttarakhand property tax is an annual levy imposed by the municipal corporation of Uttarakhand on the owners of residential, commercial, and industrial properties located within its jurisdictional boundaries. The tax is calculated based on the total value of the property, including the land and the buildings constructed on it.

It is an important source of revenue for the local government and is utilized for the development and maintenance of public infrastructure such as roads, parks, and sanitation facilities. The amount of tax to be paid by the property owner is determined by the local government based on a fixed percentage of the property’s total value, which may vary depending on the property type, location, and usage.

Property Tax Important

The revenue collected through property taxes contributes directly to municipal funds used for:

- Public infrastructure maintenance

- Water supply and sanitation services

- Street lighting and parks

- Health and safety services

- Urban development projects

Failure to pay property taxes can lead to penalties, legal action, and even restrictions on selling or transferring the property.

What is NagarSewa?

NagarSewa (e-Nagar Sewa) is the digital platform developed by the Government of Uttarakhand to provide seamless access to municipal services. It covers services such as:

- Property tax payment and records

- Birth and death certificate applications and downloads

- Trade license management

- Complaints and grievance redressal

This portal reduces the need to visit municipal offices physically, promoting ease of doing civic business online.

Uttarakhand Property Tax Dues Payment Procedure

If you own a property in Uttarakhand, pay your tax dues hassle-free by following these steps:

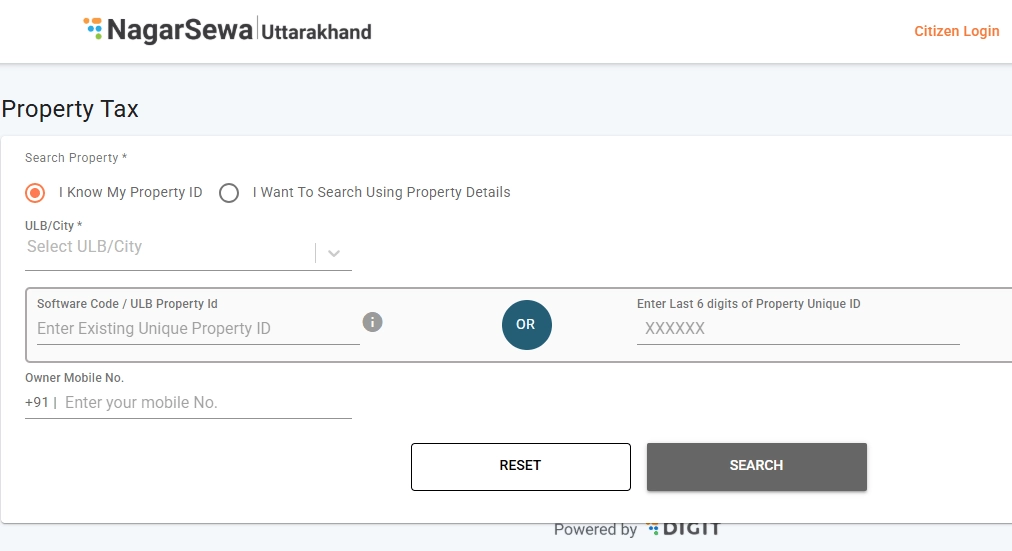

- Navigate to the official website: Visit the official Uttarakhand NagarSewa website at nagarsewa.uk.gov.in

- Property Tax Section Access: Locate the property tax link prominently displayed in the service list.

- Provide property details: Choose between the ‘I know my property ID’ or ‘Use property details’ option. Enter ULB City, Property ID, House number, and other required details.

- Retrieve property information: After registration, verify the displayed details to ensure accuracy.

- Start Payment: Click on the ‘Make Payment’ option and enter the desired amount for a full or partial payment.

- Choose Payment Method: Use internal banking services, debit cards, or any other preferred online payment method.

- Confirmation and Receipt: After successful payment, a receipt will be generated for property tax.

Alternative Methods of Payment for Property Tax

In recent years, alternative payment methods have gained significant traction due to their convenience and enhanced security. These methods differ from traditional payment options like cash, credit cards, and debit cards. They include mobile wallets, online payment platforms, and digital currencies.

Mobile wallets allow users to securely store their payment information on smartphones. This enables them to make in-store and online payments without the need to carry physical cards. Online payment platforms like PhonePe, Paytm, and Google Pay are safe and convenient ways to complete transactions. Cryptocurrency, on the other hand, is a digital currency that secures transactions and uses encryption to control the creation of new units. As these systems operate independently of traditional banking, they are less prone to fraud and hacking.

Advantages of Online Payment Platform for Property Tax

Online payment platforms like Phone Pe, Paytm, and Google Pay are safe and convenient way to make payments online. They allow consumers to send and receive money electronically, without sharing their financial information with a merchant. These platforms also offer buyer and seller protection, ensures that both parties are protected in cases of dispute.

One of the main advantages of alternative payment methods is that they offer faster transaction times and lower transaction fees compared to traditional payment methods. They also offer increased security features, such as two-factor authentication and encryption, thus, less prone to fraud and hacking.

As technology evolves, we can expect to see more innovative payment solutions in the future. For example, biometric authentication such as facial recognition and fingerprint scanning is increasingly used to securely verify transactions. Overall, alternative payment methods offer a variety of benefits to both consumers and merchants. The popularity is expected to increase in the coming years.

How to Check Your Property Tax Status Online?

The portal allows users to check their tax balance or payment history anytime:

- Visit NagarSewa

- Enter your Property ID or registered mobile number

- View current dues or confirm if previous payments were recorded

This feature helps avoid missing payments or overpaying.

Calculating Property Tax in Uttarakhand

While the online portal calculates your dues automatically, it helps to understand the basis of calculation:

Factors Influencing Tax:

- Unit Area Value (UAV): The municipal corporation sets a value per square foot depending on locality.

- Property Use: Residential properties usually have lower rates than commercial ones.

- Built-up Area: Tax is proportional to the built area in square feet or meters.

- Occupancy: Rented or commercial use attracts higher tax.

- Age of Property: Some municipalities offer rebates on older buildings.

Example:

If UAV = ₹1000/ sq.ft, and your property is 1000 sq.ft residential, annual tax = 1000 x 1000 = ₹1,000,000 (adjusted for occupancy and other factors).

Common Problems and How to Resolve Them

Forgot Property ID

- Check old tax receipts or municipal bills.

- Contact your local municipal office.

- Use name or address search on NagarSewa (if available).

Payment Not Reflected

- Wait for 24–48 hours as systems sync.

- Contact NagarSewa helpdesk with transaction details.

Website Down or Slow

- Try during off-peak hours.

- Use mobile app versions if available.

- Visit municipal office as a last resort.

Important Tips for Property Owners

- Always pay property tax on time to avoid penalties.

- Keep your property documents and receipts safely.

- Regularly check your tax status online.

- Use only the official NagarSewa portal or trusted municipal websites.

- Beware of fraudulent websites or agents claiming to pay tax on your behalf.

Conclusion

Paying Uttarakhand property tax through the NagarSewa portal is a streamlined, hassle-free process designed to save time and ensure transparency. From cities like Dehradun and Roorkee to smaller towns, the portal is your one-stop solution for property tax payment and other civic services.

By embracing digital governance, Uttarakhand is making it easier for citizens to comply with tax laws while contributing to the development of urban infrastructure and services. Always keep your property records updated, use official portals, and pay taxes promptly to avoid any legal complications.

More Information

Stay updated on the latest developments in the real estate industry by following the openplot information.

Our platform offers valuable insights and updates, along with informative articles and market reports. Openplot.com helps find or sell a home, which is a significant milestone.

Frequently Asked Questions

Q. Can I pay property tax offline?

A: Yes, but online payment through NagarSewa is recommended for speed and convenience.

Q: How do I find my Property ID?

A: It’s usually on your previous tax bills or municipal records. If lost, you can visit the municipal office or use search options on the portal.

Q: Is there any penalty for late payment?

A: Yes, penalties and interest are applied as per municipal rules if taxes are paid after the due date.

Q: Can I apply for rebates or exemptions?

A: Some categories like older citizens, government employees, or person with a disability, individuals may qualify. Check with your local municipality.