Introduction

Home buyers in Uttar Pradesh (UP) must pay stamp duty and registration fees as determined by the government. At the time of property registration in the state. Stamp duty is calculated based on the market value of the property. The varies depending on the location and type of property. Home buyers in UP should be aware of any additional charges or taxes that may apply during the registration process. Openplot explains the stamp duty and registration fees.

Table of Contents

- Uttar Pradesh Stamp Duty and Property Registration Charges in 2024

- Uttar Pradesh Stamp Duty on Other Deeds in 2024

- Stamp Duty on Property Gifting Within a Family in Uttar Pradesh

- Latest Decision on Reduction of Stamp Duty

- Stamp Duty Law in Uttar Pradesh

- Stamp Duty for Women in Uttar Pradesh

- Property Registration Charges in Uttar Pradesh in 2024

- How to Pay Stamp Duty Online in Uttar Pradesh?

This guide will help you to know the stamp duty and registration fee applicable to the property registry in UP in 2024. These charges include Goods and Services Tax (GST), legal fees, and any arrears on the property. Home buyers should budget for these additional costs to avoid them. If any surprises during the registration process reach out to the customer service team for assistance.

Uttar Pradesh Stamp Duty and Property Registration Charges in 2024

1% discount on stamp duty charges for women in UP. However, this discount is limited to the total transaction value of Rs. Applicable up to 10 lakhs only. This initiative aims to promote property ownership among women and empower them financially. It provides an incentive for women to invest in real estate and secure their future.

| Owner | Stamp duty as percentage of the property value | Registration charge as percentage of the property value | Stamp duty and registration charge in Rupees on a property worth Rs 10 lakh |

| Man | 7% | 1% | Rs 70,000 + Rs 10,000 |

| Woman | 6%* | 1% | Rs 50,000* + Rs 10,000 |

| Man + woman | 6.5% | 1% | Rs 65,000 + Rs 10,000 |

| Man + Man | 7% | 1% | Rs 70,000 + Rs 10,000 |

| Woman + woman | 6% | 1% | Rs 50,000* + Rs 10,000 |

Uttar Pradesh Stamp Duty on Other Deeds in 2024

2024 Uttar Pradesh Stamp Duty on Other Deeds The stamp duty rates on other deeds in Uttar Pradesh for the year 2024 are determined by the state government and are subject to change based on property value and type of transaction. It is important to consult with a legal or financial advisor to ensure compliance with current regulations.

| Documents to be Registered | Stamp Duty in Rs |

| Gift deed | 5% of the property value Rs 5,000 in case of gifting in family members |

| Will | Rs 200 |

| Exchange deed | 3% |

| Lease deed | Rs 200 |

| Agreement | Rs 10 |

| Adoption deed | Rs 100 |

| Divorce | Rs 50 |

| Bond | Rs 200 |

| Affidavit | Rs 10 |

| Notary | Rs 10 |

| Special power of attorney | Rs 100 |

| General power of attorney | Rs 10 to Rs 100 |

Stamp Duty on Property Gifting Within a Family in Uttar Pradesh

The standard stamp duty for the transfer of property between blood relatives in Uttar Pradesh on February 10, 2024, is Rs. 5,000. This reduced rate of stamp duty will encourage more property transfers within families and encourage the transfer of wealth across generations. This will benefit people who are looking to pass on property to their loved ones without incurring high transfer costs.

Indian Stamp (Uttar Pradesh Amendment) Bill, 2024. There is a provision that property can be transferred between blood relatives on payment of a stamp duty of 5,000. It was passed by the Uttar Pradesh Assembly on February 9. The bill aims to facilitate the process of transfer of property within families. Reduce the financial burden on blood relatives.

This amendment is expected to promote smooth intergenerational wealth transfers. Facilitates transfer of property inheritance. As processing is free along with Rs.5,000 stamp duty, and additional processing fee of Rs.1,000 has to be paid. However, this exemption in stamp duty is valid only for a limited period of six months for certain transfers.

Applicable family members

in 2024 the reduced charges will apply only to property transfers to one’s

- Father

- Mother

- Brother

- Sister

- Spouse

- Son

- Daughter

- Son-in-law

- Daughter-in-law

- The eldest children from the son and daughter’s side

Latest Decision on Reduction of Stamp Duty

Earlier, property owners in UP had to pay a 7% stamp duty on property transfers. Their family, along with the 1% registration charge. Is a significant financial burden for many people looking to buy or sell property in the state. However, with the recent decision to reduce stamp duty to 5% to boost the real estate market, property transactions are likely to pick up.

Reduction in stamp duty is expected to boost property transactions in Uttar Pradesh. More affordable and accessible to both buyers and sellers. This move is expected to stimulate economic activity in the real estate sector. It can attract more investors to the state.

The high rate has discouraged many employers from transferring. Their property is between family members during their lifetime. Now it can easily change the names of family members. This streamlined process makes it more convenient for people to transfer property. This simplification encourages more owners to consider transferring their property between family members during their lifetime.

Stamp Duty Law in Uttar Pradesh

As per section 17 of the Uttar Pradesh Registration Act of 1908, if the transaction value is more than Rs.100 then the buyer has to register the sale deed in the office of the Sub-Registrar. Failure to register the sale deed can result in legal consequences, including the document being declared invalid in case of any disputes.

Buyers need to ensure timely registration to protect their ownership rights. Can avoid any complications in the future. Buyers should also be aware that registration fees are applicable based on the transaction value. These fees must be paid at the time of registration. Failure to pay the registration fees can also lead to legal issues and delays in completing the property transaction.

Stamp Duty for Women in Uttar Pradesh

Like many states, women have uniformly reduced stamp duty on property registration. Women in Uttar Pradesh get a discount on this charge. Properties can be purchased only under a certain price bracket. This initiative aims to promote gender equality. Encouraging women to invest in property. It also helps in financially empowering women and increasing their participation in the real estate market.

If an individual is a property holder, the applicable 7% stamp duty is payable. In case of women Rs. Rs. 6% stamp duty is payable on registration of properties worth Rs 10 lakhs or less. Rs. For properties worth more than 10 lakhs, the rate of stamp duty for women is 7%. It is important to note that stamp duty rates may vary based on the gender of the property holder and the value of the registered property.

Stamp duty rates are different for he and she to promote gender equality. Encourage women to invest in property. But the property value in Uttar Pradesh for both he and she is Rs. 10 lakhs to pay the same stamp duty. It is advisable to check with local authorities to determine the exact rate of stamp duty applicable to a particular property transaction.

Property Registration Charges in Uttar Pradesh in 2024

The Uttar Pradesh government has announced new stamp duty rates for 2020. It has also reduced the registration fees for property and other transactions. It has capped a maximum charge of Rs 20,000 on transactions. Some provisions have been removed. The new rates have been imposed to promote the real estate sector and attract more investments in the state.

These changes are expected to make property transactions more affordable for buyers and investors. The government hopes that these changes will spur economic growth. The development in Uttar Pradesh. The new stamp duty rates and registration fees are expected to have a positive impact on the real estate market in the state.

How to Pay Stamp Duty Online in Uttar Pradesh?

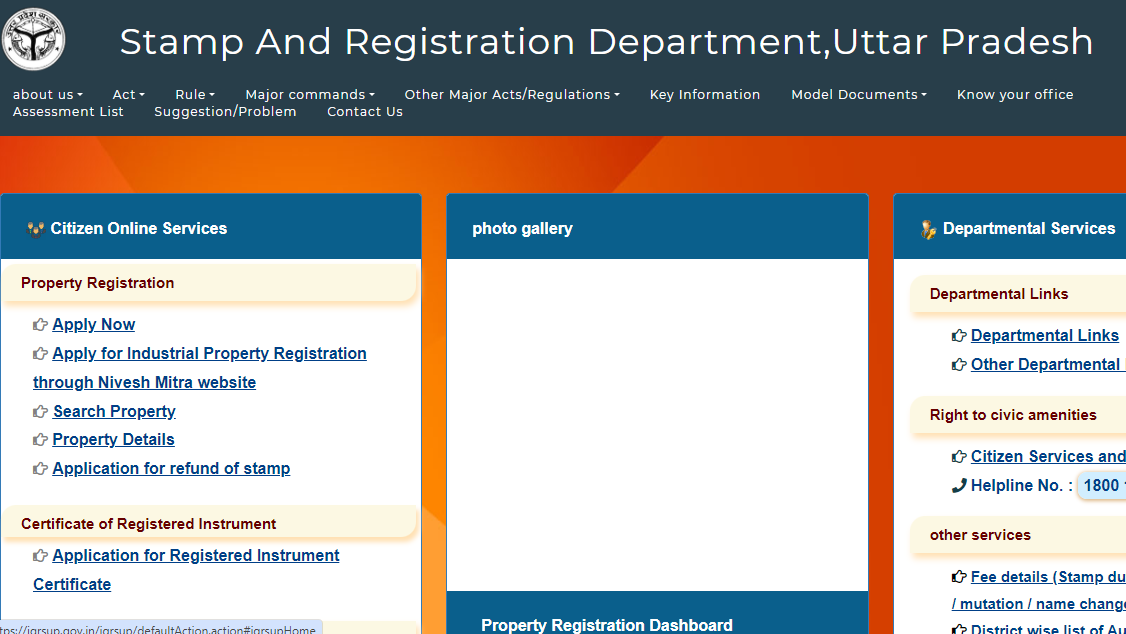

- Login to the Stamp and Registration Department Uttar Pradesh portal. After you select the “Apply Now” option, you will have the option to switch to English.

- You can log in without registering using your credentials.

- After this, you need to enter details of the property, buyer, seller, and witnesses.

- Once you fill in all those details, the system will automatically calculate the stamp duty and registration charges for your property.

- After you pay the stamp duty, a receipt number will be generated.

- Save this number for future use and book an appointment for property registration at the Sub-Registrar’s office.

Conclusion

Uttar Pradesh Stamp Duty and Property Registration Charges Revised in 2024. It provides a conducive environment for property transactions in the state. These speculations can attract more investors. Then home buyers to the real estate market in Uttar Pradesh. Stability in stamp duty and property registration charges will contribute to steady growth in the real estate sector. It aims to boost economic activity in Uttar Pradesh.

| Also Read Stamp Duty and Property Registration Fees in Hyderabad The Hyderabad housing market in India is exhibiting a continuous growth trend with increasing value. In one of the most populous metropolises in the country, Hyderabad property prices vary according to its population. Know the Latest Ready Reckoner Rate in Bhakti Mandir, Thane? Bhakti Park is a suburban area of Mumbai located along LBS Marg and the Eastern Express Highway. Strong road connectivity and proximity to employment zones have paved the way for increased property demand in Bhakti Mandir. December 2023 Hyderabad Property Sale Registration Record High Hyderabad: According to the latest report released by Knight Frank India, Hyderabad real estate ended. The year 2023 was on a positive note as residential property registrations rose to a record high of 7,254 in December 2023. |