Introduction

Udaipur Municipal Corporation (UMC) is responsible for collection and collection of property tax in Udaipur. Udaipur property owners must pay tax. It is the taxpayer’s responsibility. Payable by 31st March every year. Otherwise, UMC imposes penalties on property taxpayers. openplot explains the Udaipur property tax guide step by step.

Table of Contents

- What is the Udaipur Municipal Corporation?

- How to Calculate Property Tax in Udaipur?

- Formulas For Calculating Property Tax in Udaipur

- Property Tax in Udaipur Online Process

- How to Pay Udaipur Municipal Corporation Property Tax Offline?

- Udaipur Municipal Corporation Property Tax Rebates

- Frequently Asked Questions

The actual amount you pay depends on various factors, such as tax rates, region, and other parameters, as well as your property type. Therefore, the taxpayer depends on the area where the property is located.

The value of your property and any exemptions or deductions you may qualify for can also impact the final amount you owe in property taxes. Udaipur has a well-organized property tax system to benefit all the residents. Property tax is an important source of revenue as it is used in the development of infrastructure and facilities.

What is the Udaipur Municipal Corporation?

The Udaipur Municipal Corporation (UMC) fixes various property tax rates and collects the payments. UMC provides easy access to online payments and offline payments as well. Tax rates vary depending on the location and type of your property residential, commercial, institutional, and industrial. So, you need to know the property tax payment amount.

UMC also offers discounts for early payments and penalties for late payments to encourage timely settlements. Property owners can avail of exemptions or deductions based on certain criteria, such as age, disability, or ownership of a single property. If you are an investor in the real estate market, you must know about the property tax process.

How to Calculate Property Tax in Udaipur?

Udaipur Municipal Corporation (UMC) follows the Urban Development (UD) tax structure for the property tax calculation. This tax structure takes into account factors such as the size, location, and type of property to determine the tax amount. Property owners in Udaipur can access online portals to calculate their property tax and make payments conveniently.

The online portals also provide information on any exemptions or deductions that may apply. Make it easier for property owners to understand their tax obligations. This digital platform helps streamline the tax payment process and ensures transparency in the collection of revenue for UMC. So, important unit terms that citizens must be familiar with before proceeding with tax calculation are as follows:

- 1 sq. m. = 9 sq. ft.

- 1 sq m = 10.76 sq ft

- 1 sq m = 1.195 sq yd

- Plot Area = Tax can be calculated for the entire plot or area of the property

- Area of foundation = Total area of structure

- Vacant area = total vacant area on a plot or property

- The plinth area may or may not be the same as the build-up area

Formulas For Calculating Property Tax in Udaipur

There are various formulas for calculating property tax in Udaipur for different types of properties. Calculate this formula using the formula that applies to your property type. For residential properties, the formula typically includes factors such as property size, location, and amenities. Commercial properties may have a different formula based on factors like business type and revenue.

Here are the formulas to compute property tax in Udaipur

| Type of Properties | Tax Calculation Formulas |

|---|---|

| Residential | (Plot area (sq yd) X DLC residential rate) / 2,000 |

| Flats | (Flat build-up area (in sq yd) X DLC residential rate) / 2,000 |

| Commercial | (Plot area / build-up area (Whichever is more) (in sq yd) X DLC commercial rate) / 2,000 |

| Institutional | (Plot area / Build-up area (Sq yd) x DLC institutional rate) / 2,000 |

| Industrial | (Plot area / Build-up area (Whichever is more) (in sq yd) X DLC industrial rate) / 2,000 |

Property Tax in Udaipur Online Process

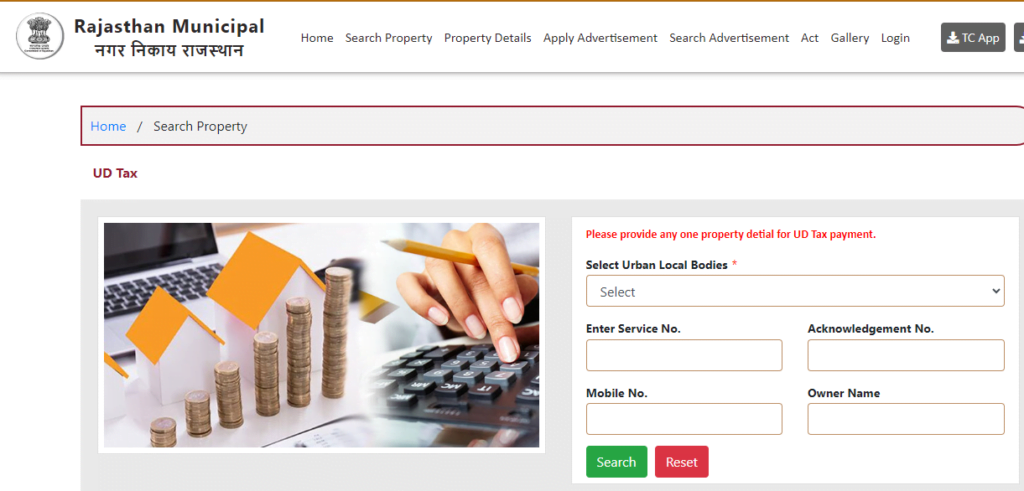

Udaipur Municipal Corporation (UMC) has provided a user-friendly portal for the Udaipur property tax payment process. The portal allows residents to easily calculate their property tax. They make online payments and access and download the receipts. It has streamlined the payment process and increased transparency for taxpayers in Udaipur.

Residents can also track the status of their payments and receive timely reminders for upcoming dues through the portal. This initiative by UMC has not only simplified the tax payment process but also improved overall efficiency in managing property taxes in Udaipur. Here are steps to pay property tax in Udaipur online without any hassle.

- Visit the official Udaipur Municipal Corporation (UMC) website.

- Click on ‘Property Tax Online‘ under the ‘Citizen Services’ tab on the homepage.

- Now, select ULB and enter the service number, receipt number, your mobile number, or property owner name.

- Click on the ‘Search’ button to pay property tax.

How to Pay Udaipur Municipal Corporation Property Tax Offline?

If you are willing to pay your Udaipur property tax offline, first visit the nearest UMC department office. Once there, you can request a physical copy of the tax bill and make your payment in person. Remember to bring any necessary documentation and payment method with you for a smooth transaction. If you go to the UMC department office, you must collect the required form from the office and fill it with the correct and valid details.

Once you have completed the form, make sure to return it to the office by the deadline to avoid any delays in processing your request. Remember to double-check all information before submitting to ensure accuracy. It is important to follow any specific instructions provided by the office to ensure that your form is completed correctly. Failure to follow these guidelines may result in your request being delayed or denied. So, don’t delay that property tax pay.

- Address: Udaipur Municipal Corporation, Udaipur, Rajasthan, 313001

- Helpline Number: 0294 242 6262

- E-mail: commudr@gmail.com

Udaipur Municipal Corporation Property Tax Rebates

The rebate amount for property tax in Udaipur depends on the timing of your tax payment. The earlier you pay your property tax, the higher the rebate amount you will receive. It is important to check with the local municipality for specific details on rebate eligibility and deadlines. Additionally, make sure to keep track of any changes in rebate policies that may affect your eligibility. Forgetting the deadlines or failing to meet requirements could result in a loss of potential savings on your property tax bill.

If you are a female property owner, you are eligible for an additional 10 percent rebate over and above the rebate percentage given in the table below. This special concession recognizes and supports women property owners in our community. It aims to provide additional financial support and encourage more women to invest in real estate.

| Between 1 April and 30 June | 10 percent Rebate on Current Year Tax |

|---|---|

| Between 1 July and 30 September | 5 percent rebate on the current year tax |

| Between 1 October and 31 December | No rebate |

| Between 1 January and 31 March | No rebate |

Conclusion

Udaipur Municipal Corporation Property Tax provides detailed information on how to calculate Udaipur property tax, pay online, and avail any exemptions or concessions available. Residents of Udaipur can rest assured that they are doing their civic duty. At the same time, they can get any benefits they are entitled to.

All property owners need to understand the property tax system in Udaipur to avoid any penalties or legal issues. By staying informed and adhering to the rules outlined by the Udaipur Municipal Corporation, residents can contribute to the development and maintenance of their city.

| Also read Kota Nagar Nigam: How to Pay Property Tax Online and Offline If you are a Fort resident and own a property, paying your property tax is a crucial responsibility. Kota Nagar Nigam provides a convenient online platform for property owners to pay their taxes hassle-free. How to Pay Property Taxes to Durg Municipal Corporation Durg Municipal Corporation (DMC) has simplified the property tax payment process. Residents can now pay their property tax online through the DMC website, which is more convenient and efficient. Jammu and Kashmir Property Tax Has Announced a New Tax Policy Property tax in Jammu and Kashmir is determined based on the Taxable Annual Value (TAV). The TAV is calculated by multiplying the property’s Annual Rental Value (ARV) by a certain percentage. The local government determines this percentage, which can vary depending on the type and location of the property. |

Frequently Asked Questions

Q. How do I calculate the annual rental value?

A. Formula for calculating monthly rental value: Annual rental value = Monthly rental value x 12 – 10%.

Q. How do I pay Property tax in Udaipur, Online?

A. To pay Udaipur property tax online, you must enter a valid service number, receipt number, mobile number, or owner name.

Q. Who is the Current Mayor of Udaipur Municipal Corporation?

A. “Govind Singh Tank” is the current mayor of the corporation.