Introduction

Manikonda Municipality administers property tax payments. You can pay property tax online through the Commissioner and Director of Municipal Administration (CDMA) Telangana. This online payment system allows residents to settle their property tax dues conveniently. Online payment eliminates the need to visit the municipality office in person. This blog explains How to pay property tax in Manikonda.

Table of Contents

- How to Assess Manikonda Property Tax Based on Annual Rental Value?

- Calculate the Manikonda Property Tax

- How to Pay Manikonda Property Tax Online?

- Manikonda Property Tax: How to Pay Offline?

- Mobile App Option

- Penalty for Late Payment of Property Tax

- How to Apply for Property Mutation?

- Documents Required for Property Mutation in Manikonda

- Frequently Asked Questions

However, you must have a valid Prepare Tax Identification Number (PTIN) or door number to calculate and pay your tax online. If you don’t have a PTIN number, you can’t pay property tax online at that time. Make sure to obtain a PTIN number from the relevant tax authority before attempting to pay your property tax online.

Without this identification number, you will not be able to complete the transaction electronically. Having a PTIN number helps ensure that your tax payment is credited to your account. It is an essential requirement for online tax transactions to prevent errors and delays in processing.

How to Assess Manikonda Property Tax Based on Annual Rental Value?

Manikonda property tax is assessed based on annual rental value and rate of taxes. Payment of property tax is important. Because it can be used to improve infrastructure and public amenities. This tax revenue is critical to maintaining roads, schools, and other essential services in the region. By paying property tax, residents contribute to the overall development and prosperity of their community.

The property tax payments help fund emergency services such as fire departments and police stations. Therefore, residents must fulfill their responsibility to support the growth and safety of their neighborhoods. Property tax payments play a vital role in ensuring a high quality of life for all residents of a community.

Calculate the Manikonda Property Tax

Commissioner and Director of Municipal Administration (CDMA), Telangana provides a tax calculator on its official website. So, you can know the property tax dues. It is easy to use. Property tax is calculated based on the annual rental value and tax rate. Simply enter the required details, such as property type and location. Into the calculator to get an accurate estimate of your property tax dues.

This can help you plan and budget accordingly for your tax payments. The tax calculator allows you to compare your property tax dues with previous years. Helping you track any changes in rates or values. This can assist in making informed decisions regarding your property investments and financial planning. Below are the requirements and documents for the Manikonda Property Tax Calculator:

- A registered title deed, court decree, or title is available

- Building permit

- District

- ULB

- Name of locality or village panchayat

- Street Name and Zone

- Total plot area (in sq. yd.)

- Floor no

- Sanction Plinth Area (in sq. Meters)

- Use of sanctioned building

- Classification of building

- Utilization of constructed building

- Type of resident

- Sanction number of floors

- Construction Value (per sq ft)

- Constructed Length (Mtr)

- Constructed Width (Mtr)

- Plinth Area (in sq. Meters)

How to Pay Manikonda Property Tax Online?

Residents can pay Manikonda property tax online through the official website. It can easily be accessing the property tax. However, they must have the correct property tax identification number or door number. Residents can also choose to pay their property tax in person at the nearest municipal office.

This option allows for any questions or concerns to be addressed immediately by a customer service representative. Residents can also opt to pay their property tax through mobile banking apps or at designated payment centers. This provides added convenience for those who may not have access to the Internet or prefer alternative payment methods.

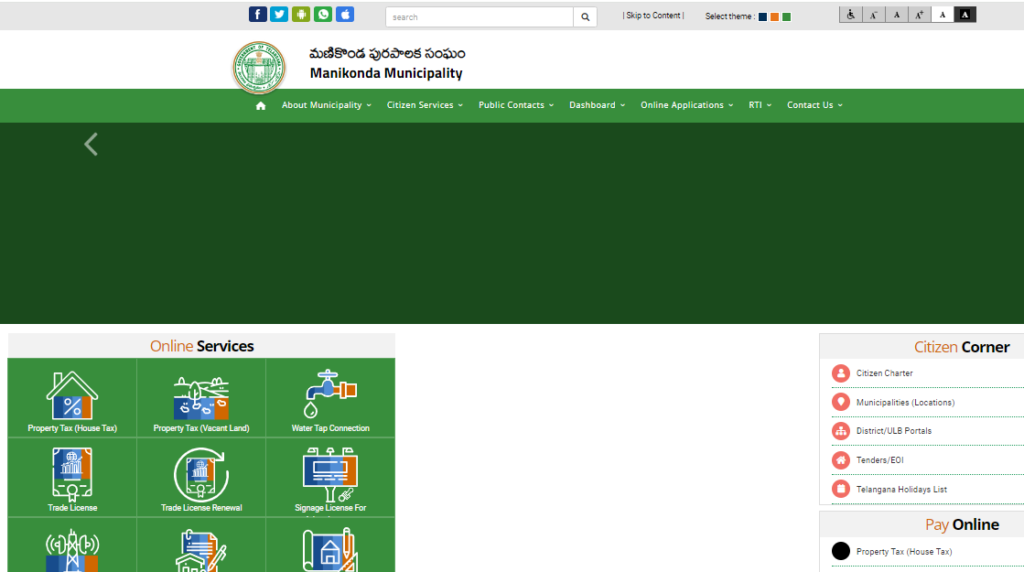

- Taxpayers first Visit the official website of Manikonda Municipality.

- Click on the ‘Property Tax (House Tax)’ link under the ‘Online Services’ tab.

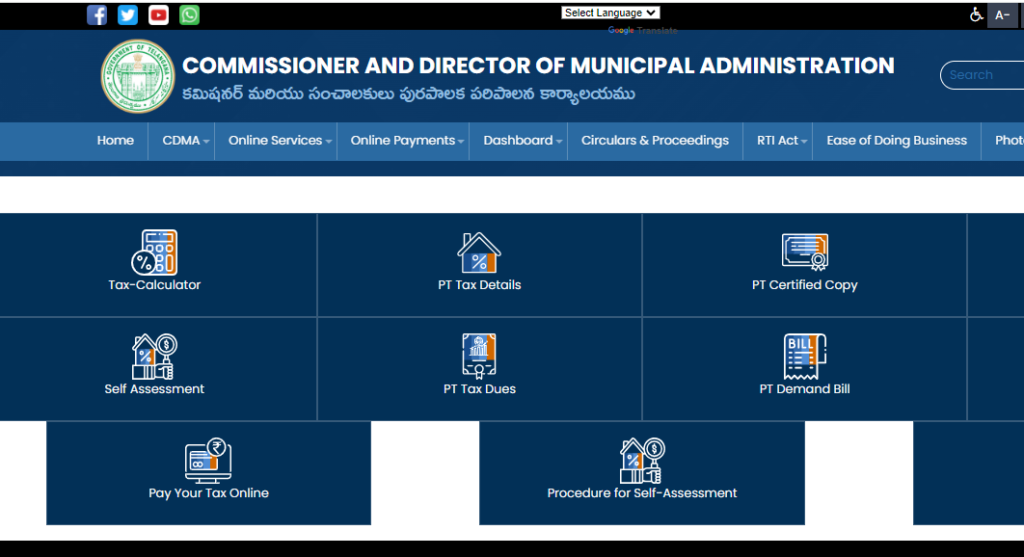

- You will be redirected to the CDMA website, emunicipal.telangana.gov.in.

- Click on the ‘Pay Your Tax Online‘ link.

- To pay tax through your Property Tax Information (PTI) number, enter the Property Tax Identification Number (PTIN) or ASMT and click on the ‘Know Property Tax Dues’ button.

- To pay tax through your door number, enter the District, ULB, PTIN number, and door number and click on the ‘Get Property Details’ button.

Manikonda Property Tax: How to Pay Offline?

A property in Manikonda is enough. So, you must pay your Manikonda property tax offline. You must visit the municipality office during working hours to understand the process. You do not need to visit the Municipal Office in person. Can you inquire about the process over the phone or check the municipality’s website for more information.

Remember to keep all necessary documents and payments ready while visiting the office. Its inquiries about any specific forms or requirements for offline payment. It is important to follow all instructions carefully to ensure that your Manikonda property tax is paid correctly and on time. If you fail to get the property on time, you will have to bear the penalties. So, be prepared to pay every year for property tax.

- Phone: 040 2312 0410 (10 AM to 5 PM)

- E-mail ID: cdmasupport@cgg.gov.in

- Last Date: Every year April 30

Mobile App Option

You can also download the Manikonda Municipality Mobile App to:

- Pay your property tax

- Track payment history

- File complaints

- Get real-time notifications

It’s a handy tool if you prefer managing things on the go!

Penalty for Late Payment of Property Tax

You have a property in Manikonda. So, you need to pay the property tax. Citizens who fail to pay the Manikonda Property tax on or before the last date will be required to pay a penalty for delayed payment. It is important to ensure timely payment of property tax to avoid any additional financial burden. Failure to pay on time may result in further consequences such as legal action or increased penalties.

If they settle their property tax bill within the stipulated time, they are reward with a rebate equal to 5 percent of the total amount. So, try to pay before April 30. If you pay on time, you will get a discount later. This incentive favors property owners to settle their tax liabilities promptly, benefiting from the financial savings provided by the concession. By availing of this opportunity, individuals can effectively manage their finances and effectively avoid any late fees or penalties.

How to Apply for Property Mutation?

Online Process:

- Visit the Official Portal: Go to the Manikonda Municipality website.

- Navigate to Mutations: Under ‘Citizen Services’, select ‘Mutations’.

- Fill in Details: Enter the required property and personal details.

- Upload Documents: Attach scanned copies of the necessary documents.

- Pay Mutation Fee: Make the payment online as per the calculated fee.

- Submit Application: After submission, you’ll receive an acknowledgment with a unique application number.

Offline Process:

- Prepare Documents: Gather all required documents as listed above.

- Visit the Municipality Office: Go to the Manikonda Municipality office.

- Submit Application: Provide the documents along with the mutation application form.

- Pay Mutation Fee: Submit the Demand Draft for the mutation fee.

- Acknowledgment Receipt: Collect the receipt with your application number for future reference.

Documents Required for Property Mutation in Manikonda

- Registered Sale Deed (Certified Copy): Proof of the property’s legal transfer from the seller to the buyer.

- Latest Encumbrance Certificate (EC): To confirm that the property is free from any legal dues or liabilities.

- Latest Property Tax Paid Receipt: To ensure all previous dues are cleared.

- Notice of Transfer (Form-1): As per Section 208 of the GHMC Act, signed by both the seller and buyer.

- Aadhaar Card (Buyer & Seller): For identity verification.

- Passport-size Photographs (Buyer & Seller): Usually two recent photographs are required.

- Affidavit cum Indemnity Bond (Notarized): On Rs. 50 non-judicial stamp paper, indemnifying the municipal body against any claims.

- Electricity Bill/Water Bill Copy: As proof of property possession (optional but sometimes requested).

- PAN Card Copy: Especially if the property value exceeds a certain amount (for tax purposes).

- Demand Draft (DD) for Mutation Fee: 0.1% of property market value, favoring the Commissioner, GHMC.

Conclusion

Manikonda Property Tax is a simple process that can be done online through the official website of the Commissioner and Director of Municipal Administration. Manikonda Property Tax website, property owners can easily make their tax payments from the comfort of their own homes. If you can duly the property tax get the reduces. Will be required to pay a penalty for delayed payment.

More Information

Stay updated on the latest developments in the real estate industry by following the openplot information.

Our platform offers valuable insights and updates, along with informative articles and market reports. Openplot.com helps find or sell a home, which is a significant milestone.

| Also read CDMA Telangana Property Tax: Why is Important? When it comes to property taxes in Telangana, the CDMA (Commissioner and Director of Municipal Administration) plays a crucial role in the assessment, collection, and management of property taxes. In this blog post, we will explore the ins and outs of CDMA Telangana property tax. Telangana Property Tax Online Payment and Property Tax Return File The official website of the Telangana Municipal Corporation allows Properties or House Taxes payments to be made online. Like other municipal corporations, the Telangana Municipal Corporation is responsible for various tasks such as water management, waste management, infrastructure. Nagpur Property Tax: How to pay Online Payment If you are buying a property, you must know all the costs associated with the purchase of the property. For every property you own in Nagpur, the municipality levies a direct tax called property tax. Telangana Government Will Increase the Market Value of Land from August 1 The Telangana government has announced a significant revision in the market value of land in different categories with effect from August 1, 2024. This revision will increase the registration and stamp duty charges for property transactions. |

Frequently Asked Questions

Q. How do I Pay Hyderabad Property Tax Online?

A. You can by the official GHMC website and online payment portal.

Q. Manikonda is under which municipality?

A. Manikonda is an urban local body belonging to the municipality of Rangareddy district in the state of Telangana.

Q. Where should I pay Manikonda property tax?

A. Property owners can pay property tax in Manikonda online through the official CDMA website “emunicipal.telangana.gov.in.“