Introduction

The City of Kurnool lies in the state of Andhra Pradesh. Kurnool Municipal Corporation (KMC) handles the collection of taxes. So, every property owner’s responsibility is to pay the property tax. Property tax is a crucial source of revenue for the municipality. Which is used for maintaining infrastructure and providing essential services to residents. Openplot gives Kurnool property tax pay process.

Table of Contents

- Kurnool Property Tax Calculate

- How to Pay Kurnool Municipal Corporation Property Tax Online

- Kurnool Municipal Corporation: Mutation Process

- How to Pay Kurnool Property Tax Offline?

- Property Tax Rate in Kurnool

- How to Check Your Property Tax Dues in Kurnool?

- Frequently Asked Questions

Kurnool property tax was constituted in the year 1994. It is headed by a mayor and is governed by a commissioner. So, Kurnool taxpayers pay the timely. In case Failure to pay property, tax can result in penalties or legal action by the municipal corporation. Property owners need to ensure timely payment of property tax to avoid any consequences. Staying up to date with property tax payments helps in the overall development and upkeep of the city.

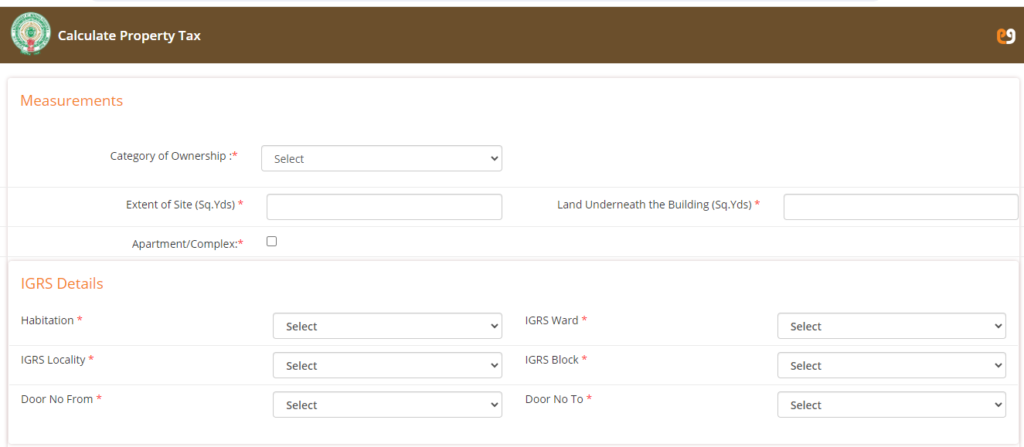

Kurnool Property Tax Calculate

The Kurnool property tax can be defined as a tax imposed on real estate owners by the Municipal corporation. Paying property or house tax in Kurnool Municipal Corporation via the official portal. Taxpayers can user-friendly portal.

The portal allows property owners to easily calculate and pay their taxes online. Saving time and effort. It also provides a convenient way to access tax payment history and receipts for record-keeping purposes. Property tax calculation can be defined as the below formula.

| Property Tax => Base property value multiplied by type of building, multiplied by age factor, multiplied by floor factor, multiplied by category of use. |

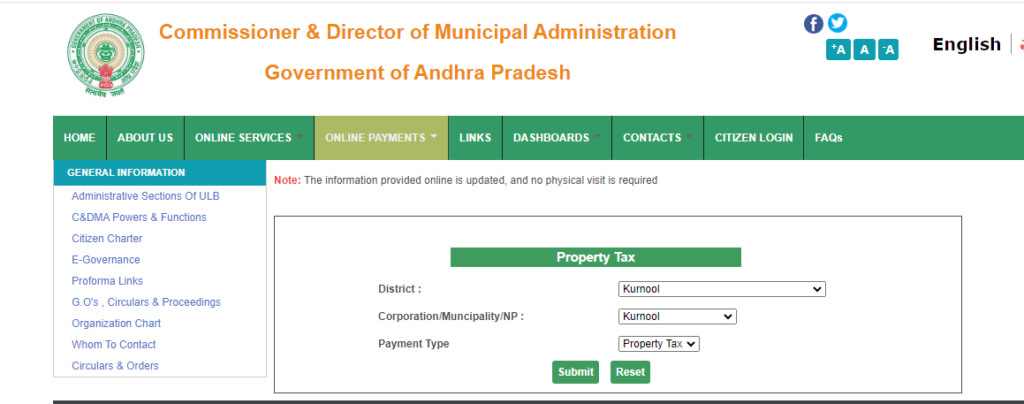

How to Pay Kurnool Municipal Corporation Property Tax Online

You have a property in Kurnool. However, you need to know how to pay online payment process. It is used to make payments online, so you can time save. Now let’s see the steps on how to make property tax payments online in Kurnool Municipal Corporation.

- Then click on the Online Payment icon and scroll down you can see Property tax.

- Here select District and Corporation, you need to select Kurnool Municipal Corporation.

- After that, select the payment type and click on Property Tax.

- You will be redirected to a new page where you have to enter the assessment number.

- Old assessment number, owner name, and door name, and then click on search.

- Then you will get the property details as per the assessment number. If all the details are correct, click on the tax payment option and you will reach the payment page.

- You can use your debit or credit card or net banking details to make payments online.

- Once the payment is completed, you will receive a transaction receipt which is required to save it for future reference.

Kurnool Municipal Corporation: Mutation Process

The Kurnool mutation of property is defined as the process by which the title of the property is changed in the local municipal records after the property has been transferred in the owner’s name. This mutation is important for establishing legal ownership of the property. Ensuring that the new owner can avail of all rights and responsibilities associated with the property.

This is usually done by applying to the local municipal authorities along with the relevant documents. The mutation process may involve fees. May take some time to complete. However, it is a crucial step in the property ownership transfer process. Once the mutation is approved, the new owner has legal recognition as the rightful owner of the property.

owner’s name acts as a Proof of possession of the Property. Using the legal document sole the smooth solution If any issues arise. This document plays a vital role in seeking water and power connections. It also serves as a record of ownership. In case of any disputes or legal matters that may arise in the future. Having a properly executed deed can provide peace of mind. Security for both the owner and the property.

Follow the steps below for payment of mutation fees:

- Navigate to the official web portal i.e. “CDMA Mutation Payment“

- Select District Kurnool and Municipality Kurnool.

- You will see the correct mutation fees for the payment type.

- Click on Application Number and Assessment Number.

- Then click on Pay Fees.

- You can make fee payments online using a debit or credit card.

- Once you generate a payment receipt, you can save it for future reference.

How to Pay Kurnool Property Tax Offline?

You need to pay your property tax in Kurnool offline. However, residents can approach the counter of their respective urban local bodies (ULBs). Besides, Taxpayers can visit the nearest Civil Service Centers (Puraseva Kendras) in their municipal office. It is important to ensure that all necessary information and documents are readily available before proceeding with the payment process.

Property Tax Rate in Kurnool

2024 property rates are increased. The latest property tax rates in Kurnool are given below:

| Name of the Kurnool urban local body | Total Residential Tax (Half-yearly) | Total Non-residential Tax (Half-yearly) |

|---|---|---|

| Kurnool | 0.075 | 0.15 |

| Yemmiganur | 0.075 | 0.15 |

| Adoni | 0.075 | 0.15 |

| Gudurknl | 0.075 | 0.15 |

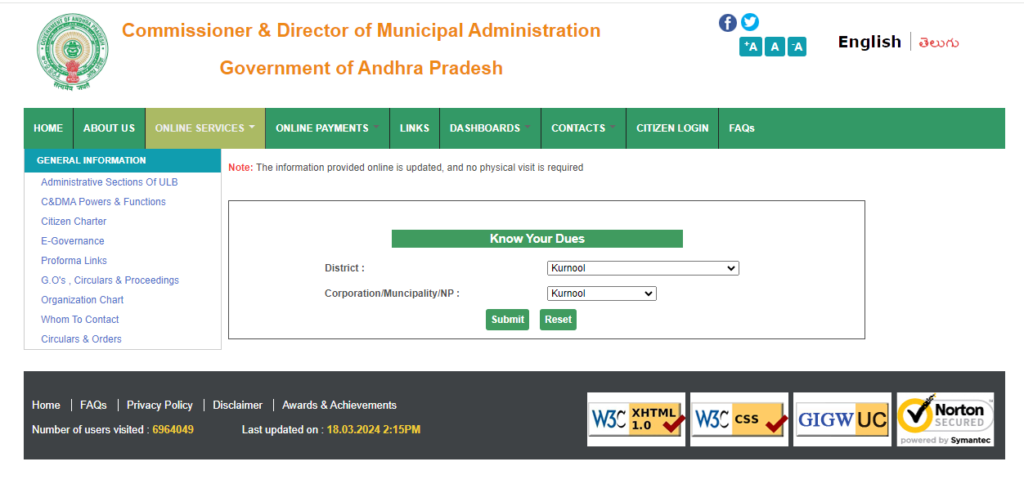

How to Check Your Property Tax Dues in Kurnool?

Andhra Pradesh offers the facility to check the property tax dues on the CDMA (Commissioner and Director of Municipal Administration) official portal. You can check if your property has dues or no dues in the tax. Follow these steps to check your dues in property tax:

- Visit the CMDA (Commissioner and Director of Municipal Administration) official website

- On the homepage, check the ‘Online Services’ section and under the ‘Property Tax’ section, click on ‘Know your dues‘

- Enter ‘District’, ‘Corporation/Municipality/NP‘ and click the ‘Submit’ button

- On the next page, specify the following details:

- Assessment no

- Old assessment no

- Owner’s Name

- Door number

- Click on the ‘Search‘ button to determine your property tax dues

Conclusion

Paying property tax online in Kurnool is convenient with the CDMA portal of the Andhra Pradesh government. The online portal allows residents to easily calculate. Those pay their property tax from the comfort of their own homes. The CDMA portal provides a secure platform for making payments. Ensuring that residents’ personal and financial information is protected.

This streamlined process saves time. Eliminates the need to physically visit government offices to pay property tax. Furthermore, the online portal also offers various payment options. It is easy for residents to choose the method that suits them best. The CDMA portal simplifies the Kurnool Property Tax payment process. Improves efficiency for Kurnool residents.

| Also read Kanyakumari Property Tax: How to Pay Online and Offline? The Nagercoil Corporation handles the Property tax payment in Kanyakumari, Tamil Nadu. So, property pay is a taxpayer’s responsibility. The corporation’s user-friendly portal allows taxpayers to pay and calculate taxes online. Do You Know How to Pay Manikonda Property Tax? Manikonda Municipality administers property tax payments. You can pay property tax online through the Commissioner and Director of Municipal Administration (CDMA) Telangana. This online payment system allows residents to settle their property tax dues conveniently. Telangana Government Will Increase the Market Value of Land from August 1 The Telangana government has announced a significant revision in the market value of land in different categories with effect from August 1, 2024. This revision will increase the registration and stamp duty charges for property transactions. Nellore Municipal Corporation (NMC): How to Pay Nellore Property Tax? In Andhra Pradesh, Nellore property tax is paid by the Commissioner & Director of Municipal Administration (CDMA). These taxes are collected twice a year, in six-month intervals, by the Nellore government. The property owner’s responsibility is the property tax in Nellore. |

Frequently Asked Questions

Q. How to Pay Andhra Pradesh (AP) Property Tax Online?

A. 4 types of Property Tax Online portals are there in Andhra Pradesh (AP).

- ULB Counter.

- Meeseva or AP Online.

- Puraseva App.

- cdma.ap.gov.in

Q. How to pay property tax online in Kurnool?

A. Taxpayers can pay property tax in Kurnool online by visiting the website of CDMA in Andhra Pradesh.

Q. Which “app” is used to pay property tax in Kurnool?

A. Property taxpayers can use the “Puraseva” app to pay their property tax in Kurnool, Andhra Pradesh.