Introduction

If you are a Fort resident and own a property, paying your property tax is a crucial responsibility. Kota Nagar Nigam provides a convenient online platform for property owners to pay their taxes hassle-free. In this blog post, we walk you through the easy steps to pay your property tax online in Kota.

Table of Contents

- RMC has Provided a Friendly Portal

- How to Calculate the Kota Nagar Nigam Property Tax?

- How to Pay Kota Nagar Nigam Property Tax Online?

- How to Pay Kota Nagar Nigam Property Tax Offline?

- Kota Property Tax Rebate

- Frequently Asked Questions

Kota Nagar Nigam Property Tax is levied compulsorily on all property owners. This should be considered a responsibility by the residents of the fort. Paying property tax helps in maintaining and improving the infrastructure and amenities in the city. Ultimately benefiting all residents.

It is important to fulfill this civic duty to ensure the smooth functioning of the local government and community. By paying property tax, residents contribute to the development and upkeep of essential services such as roads, water supply, and waste management.

RMC has Provided a Friendly Portal

To facilitate access to and payment of property tax, Rajasthan Municipal Corporation (RMC) has introduced its citizen-friendly online portal. RMC has introduced a friendly portal. By using a friendly portal, easy access is possible. Every property owner should pay the property tax. If there are two payment types, then there are offline and online ways to pay property taxes.

If taxpayers choose to go offline, this reduces the need to visit government offices. It saves you essential time and effort. A friendly portal can be easily excised. Taxpayers can conveniently access forms, information, and services from the comfort of their own homes. This online option also helps to streamline processes and reduce paperwork for both taxpayers and government agencies.

How to Calculate the Kota Nagar Nigam Property Tax?

The Rajasthan Municipal Corporation (RMC) adheres to the “Urban Development” (UD) tax structure for determining property tax. The UD tax structure takes into account factors such as property size, location, and usage to calculate the tax amount. This system aims to ensure fair and equitable taxation for all property owners within the jurisdiction of the RMC.

By considering these various factors, the RMC can accurately assess the tax burden on each property owner based on their specific circumstances. This approach helps promote transparency and accountability in the tax assessment process. They are fostering trust between the municipality and its residents.

Kota Nagar Nigam Property Tax Calculation Formulas for different types of properties for the ease of the property owners. So, important units or terms that citizens must be familiar with before proceeding with tax calculation are as follows:

- 1 sq. m. = 9 sq. ft

- 1 sq m = 10.76 sq ft

- 1 sq m = 1.195 sq yd

- DLC = District Level Committee

- Plot Area = Tax can be calculated for the entire plot or area of the property

- Plinth area = Total area of construction

- Vacant Area = Total vacant area on a plot or property

- The plinth area may or may not be the same as the build-up area

How to Pay Kota Nagar Nigam Property Tax Online?

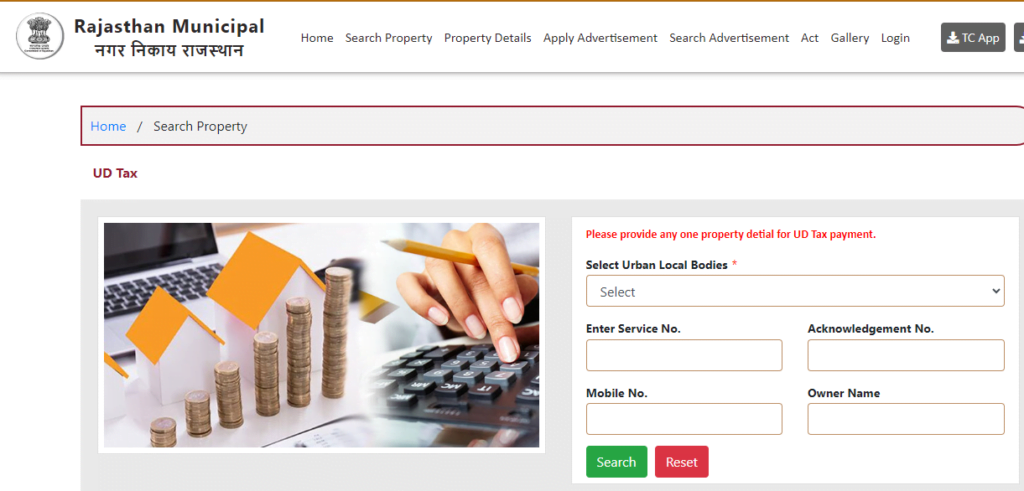

The Rajasthan Municipal Corporation (RMC) is introducing a user-friendly online portal to pay your property tax in Kota without visiting government offices. This initiative aims to streamline the tax payment process and make it more convenient for residents. The online portal will also provide access to tax history, receipts, and other relevant information. Check out the steps below on how to pay Kota Nagar Nigam Property Tax online:

- Visit the official Rajasthan Municipal Corporation’s (RMC) website.

- On the homepage, click on the ‘Pay UD Tax‘ link.

- Select ULB and enter the service number, receipt number, mobile number, or owner name.

- Click on the ‘Search‘ button for successful property tax payment.

How to Pay Kota Nagar Nigam Property Tax Offline?

If some taxpayers are willing to pay Kota Nagar Nigam property tax individually, then you must visit the Rajasthan Municipal Office during their working hours. Must they bring any necessary documents such as proof of ownership or identification to ensure a smooth tax payment process.

It may be helpful to inquire about any specific requirements or forms needed for individual tax payments at the Rajasthan Municipal Office. This will help avoid any delays or complications during the payment process. It’s always best to be prepared and have all the required documentation on hand. Still, many people visit government offices for water tax, property tax, and other tasks.

- Address: Pandit Dindayal Upadhyay Bhawan, Lal Kothi Tonk Road, Jaipur, Rajasthan – 302015

- Contact Number: – 99059 00723, 07442380618, 0744-250 1929

- E-mail: info.jaipur@sparrowsoftech.net

Kota Property Tax Rebate

Kota Nagar Nigam Property Tax Concession amount depends on your property tax payment schedule. Therefore, taxpayers need to know the new property allowances every year. That means after paying the tax to whom it applies. However, if the owner is a woman, an additional 10 percent subsidy is provided throughout the year apart from the subsidies. If the employer is a man, there is no subsidy. More benefits for women. Nigam Asti Pannu in Kota Nagar can get more subsidies in the name of women.

Conclusion

Kota Nagar Nigam property tax online provides a convenient and efficient way for residents to pay their property taxes without having to visit the municipal office in person. By using this online platform, taxpayers can save time and manage payments easily from their own homes. For this type of property and apartment information, visit the openplot. It gives more information and explains the property’s total information.

| Also read How to Pay MCD Property Tax in Delhi The Municipal Corporation of Delhi (MCD) has further tightened property tax collection norms to surpass last year’s collection figures. MCD has directed that all tax offices should function on weekends as well, apart from gazette holidays. How to Pay Kolar Property Tax Payment Online? In Karnataka, Kolar property tax payment is very easy to use online. Kolar City Municipal Council (KCMC) through its official website administers property taxes, which is a mandatory tax levied on house owners. Raigad Property Tax Online Payment Step-By-Step Guide The Rural Development & Panchayat Raj Department of the Maharashtra Government administers property tax in Raigad through its official website. Property tax is collected by the Sarpanch, Gram Sevak, or Panchayat from persons duly authorized over the property. |

Frequently Asked Questions

Q. How to pay property tax online in Rajasthan?

A. The Rajasthan government offers online tax payment facilities. Property owners can visit the “official website” of their respective municipal corporations.

Q. Who collects Kota Property tax?

A. Rajasthan Municipal Corporation (RMC) collects Kota Nagar Nigam Property tax.

Q. Who is the present Commissioner of Nagar Nigam Kota?

A. Vasudev Malawat is present Commissioner Nagar Nigam Kota.