Introduction

Off-plan properties are purchased before they are built based on the developer’s plans and designs. When buying off-plan properties, it is important to be wary of developers with a history of delayed projects or financial instability, as these could indicate potential red flags. Additionally, researching the developer’s track record and reputation in the industry can help identify any warning signs before making a purchase.

Table of Contents

- What Are Off-Plan Properties?

- Spot Red Flags Buying Off-Plan Properties

- Researching the Developer’s Reputation and Track Record

- Evaluating the Developer’s Financial Stability

- Checking for RERA Registration and Compliance

- Verifying Approvals and Permits for the Project

- Identifying Unrealistic Promises in Marketing Brochures

- Assessing the Project Timeline and Completion Guarantees

- Analyzing the Payment Plan and Hidden Charges

- Ensuring Transparency in the Builder-Buyer Agreement (BBA)

- Inspecting the Quality of Materials Promised vs Delivered

- Verifying the Availability of Basic Amenities and Infrastructure

- Frequently Asked Questions

What Are Off-Plan Properties?

Off-plan properties are those purchased before construction is completed. Buyers typically rely on architectural plans, promotional brochures, and assurances from developers. While these investments may offer attractive pricing and potential returns, they also demand careful scrutiny to avoid pitfalls.

Spot Red Flags Buying Off-Plan Properties

When considering off-plan properties, it is important to watch out for red flags that may indicate potential issues with the development. These can include delays in construction, lack of proper permits or approvals, and unreliable developers. It is crucial to thoroughly research the project and developer before making any investment decisions.

Researching the Developer’s Reputation and Track Record

When researching a real estate developer’s reputation and track record, you can consider things like:

- Experience: How many projects they’ve completed and their success rate

- Reputation: What others say about them in reviews, testimonials, and online forums.

- Delivery timelines: How well they stick to their promised completion dates.

- Quality of construction: What the quality of the materials, workmanship, and finishing are like

- Financial stability: Whether they have the financial resources to complete the project.

- Credentials: Whether they have the necessary licenses, certifications, and affiliations.

- Legal status: Whether they have the required approvals and clearances from authorities.

Evaluating the Developer’s Financial Stability

A financially stable developer is a crucial step in determining their ability to complete a project on time and within budget. Understanding their cash flow, debt levels, and profitability can provide insight into their overall financial health. Additionally, reviewing their track record with previous projects and client relationships can help assess their reliability and trustworthiness in managing finances. A financially stable developer is less likely to abandon a project midway. The developer’s stability reflects their capacity to handle unforeseen challenges.

- Financial reports: Ensure the company is solvent.

- Investor details: Understand who backs the project.

- Bank guarantees: A robust financial arrangement protects buyers in case of delays.

Checking for RERA Registration and Compliance

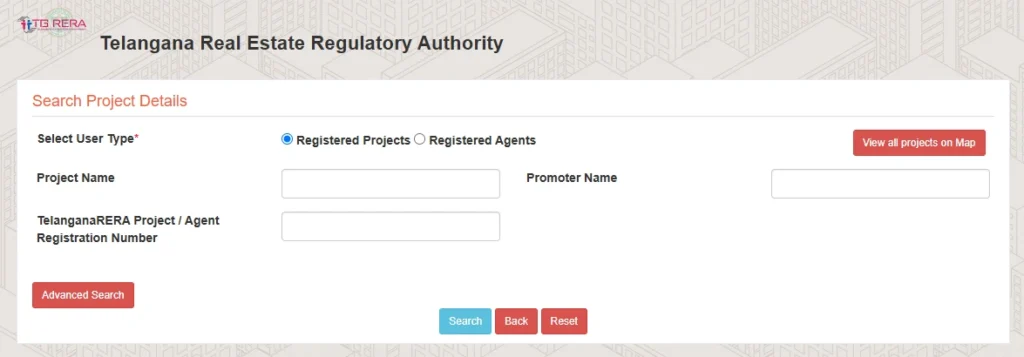

The Real Estate Regulatory Authority (RERA) ensures transparency and accountability in countries like India. RERA-compliant projects provide greater security for buyers, ensuring legal safeguards. These legitimate projects are listed on RERA portals. Compliance certificates ensure adherence to local laws and regulations. For example, Let’s see how to check for Telangana RERA registration and compliance:

- Visit the Telangana RERA website for your state.

- Search for the project by name, developer’s name, or RERA registration number.

- Review the project’s registration details, including its status, approval, and compliance information

- Check the uploaded documents, such as approved plans, legal titles, and financial disclosures.

- Confirm if the developer has obtained the RERA certificate.

Verifying Approvals and Permits for the Project

Verifying approvals and permits for the project is crucial to ensuring that all necessary approvals and permits are obtained before beginning the project to avoid any delays or legal issues. Failure to comply with regulations could result in fines or even halting the project altogether.

Additionally, not having the proper approvals could also damage the reputation of the company and impact future projects. It is important to thoroughly research and follow all necessary procedures to ensure a smooth and successful project completion. A legitimate property must have all the required clearances, including:

- Land ownership documents: Confirm the developer owns the land or has lawful rights.

- Zoning permits: Ensure the land is approved for the intended use.

- Environmental clearances: Verify compliance with environmental laws.

Identifying Unrealistic Promises in Marketing Brochures

Marketing brochures often contain promises that seem too good to be true, such as guaranteed results or exaggerated claims about a product’s effectiveness. It is important for consumers to evaluate these promises critically and consider whether they are realistic based on their knowledge and research. Glossy brochures can sometimes overstate project features. Look out for:

- Vague descriptions: Promises like “world-class amenities” without specifics.

- Enhanced visuals: Images that may not reflect the final product.

- Undeliverable timelines: Promises of completion dates that seem too optimistic.

Assessing the Project Timeline and Completion Guarantees

The project timeline and completion guarantees are crucial for ensuring successful project delivery. By closely monitoring progress and potential delays, project managers can proactively address issues and make necessary adjustments to meet deadlines. Additionally, establish clear communication channels with stakeholders.

Reliable developers commit to realistic timelines with minimal risks of delay. Understanding the project timeline is vital. When you are investing in a project or building an apartment, the project turns and conditions you read must be. If you do not understand project principles, again ask for:

- Detailed schedules: A clear roadmap from start to finish.

- Force majeure clauses: exceptions for delays caused by uncontrollable events.

- Penalty terms: compensation for missed deadlines.

Analyzing the Payment Plan and Hidden Charges

Buying off-plan properties offers staggered payment plans. These plans typically require a series of payments over the construction period, with the final payment due upon completion. It is important to review the payment schedule carefully. Understand any potential hidden charges or fees that may be associated with the purchase. Hidden charges can include maintenance fees, service charges, and utility connection fees.

It is crucial to factor in these additional costs when evaluating the overall affordability of an off-plan property. However, ensure you’re not blindsided by it. Check for price increase conditions. Maintenance fees clarify if these are included or extra. Understand GST or VAT implications. A transparent payment plan ensures you’re financially prepared throughout the process.

Ensuring Transparency in the Builder-Buyer Agreement (BBA)

Transparency in a builder-buyer agreement (BBA) is important to ensure that all parties are aware of their rights and obligations. Here are some ways to ensure transparency in a BBA:

Example: Check the standard Telangana state sales agreement format.

- The Real Estate Regulatory Authority (RERA) requires builders to use a standard format for sales agreements.

- Provide clear information: Builders should provide clear, honest information about the project and the terms of the agreement.

- Include key details: The agreement should include details such as the number of units, layout plans, and project completion timelines.

- Specify payment terms: The agreement should include a complete breakdown of all costs involved in building the property, including the payment schedule for down payments, instalments, final payments, and interest.

- Include clauses for penalties and compensation: The agreement should include clauses for penalties in cases of untimely delivery and compensation for damage defects or deficiencies.

- Include a clause for grievances and disputes: The agreement should include procedures for resolving grievances and disputes.

- Include a clause for opting out: The agreement should include a clause that allows buyers to cancel their purchases without being penalized or fined in certain circumstances.

Inspecting the Quality of Materials Promised vs Delivered

Inspecting the quality of materials promised is crucial in ensuring customer satisfaction and maintaining a positive reputation for your business. It is important to have a system in place to regularly monitor and evaluate the materials received from suppliers to avoid any discrepancies or subpar products reaching your customers.

This can involve setting up quality control measures, conducting random inspections, and communicating closely with suppliers to address any issues promptly. By prioritizing material quality, you can build trust with your customers and enhance the overall success of your business. Regularly visit the site during construction.

Verifying the Availability of Basic Amenities and Infrastructure

When buying off-plan properties, it’s easy to get caught up in promises of luxurious living. However, ensuring the availability of basic amenities and surrounding infrastructure is equally critical. A property’s long-term value and livability hinge on its connectivity, utilities, and essential services. Here’s how to verify these aspects effectively.

Prioritize Essential Utilities

A functional living space depends on the provision of basic utilities. While developers may promise these in their plans, verifying their availability and reliability is key.

- Water supply: Ensure the project has a robust and uninterrupted water source. Confirm connections to municipal lines or alternative arrangements like borewells or water tanks.

- Electricity: Investigate the power supply setup, including load capacities and backup options like generators or inverters.

- Sewage systems: Check for proper waste management facilities, including sewage treatment plants (STPs) if mandated by local laws.

Connectivity and Accessibility

A property’s location defines its practicality and convenience. Assess the surrounding infrastructure to ensure it supports comfortable living.

- Road networks: Confirm the property has well-paved roads and easy access to major highways or city centers.

- Public transportation: Verify the availability of buses, trains, or metro stations nearby to facilitate commuting.

- Internet and telecom: High-speed internet and strong mobile connectivity are modern-day essentials. Check if the area is equipped for these.

Proximity to Social Infrastructure

Evaluate the property’s access to social amenities that contribute to quality of life. Look for:

- Schools and colleges: Families prioritize educational institutions within a reasonable distance.

- Healthcare facilities: Nearby hospitals, clinics, and pharmacies are vital for emergencies and routine care.

- Shopping and recreation: Verify the presence of grocery stores, malls, parks, and other recreational hubs.

Legal Approvals for Basic Infrastructure

Developers must secure clearances for basic infrastructure to ensure proper functionality. Verify:

- Road connectivity approvals: Confirm that the project’s approach roads are sanctioned by authorities.

- Utility connections: Ensure government or local body approvals for water, electricity, and sewage systems are in place.

- Completion certificates: Developers should provide proof of completed infrastructure as promised.

Conclusion

Buying off-plan properties requires due diligence and an eye for detail. By researching the developer, verifying permits, and scrutinizing agreements, you can mitigate risks and make sound investments. Always remember that caution today can save a lifetime of regret.

| Also read What Documents Are Necessary for Buying Property in India? Buying property in India requires several important documents to ensure a smooth and legal transaction. These documents typically include proof of identity, address, income tax returns, and property registration documents. Having all the necessary paperwork is important to avoid complications during buying. Top Mistakes to Avoid When Buying Property Investing in real estate within India’s bustling urban centres can be highly rewarding but also challenging. Whether you’re eyeing property in Mumbai, Delhi, Hyderabad, and Bangalore, it’s crucial to navigate the complexities of the market wisely. Buying a Second Home for Investment in Singapore Real Estate Investing in a second home is an attractive option for many seeking to build wealth through real estate. In both Singapore and India, the real estate market has been dynamic, offering opportunities for investors. However, there are unique factors to consider before deciding on either country. |

Frequently Asked Questions

Q. How can I verify the developer’s credibility?

A. Research their past projects, customer reviews, and legal history to ensure reliability.

Q. Why is RERA registration crucial?

A. RERA ensures compliance with laws, protecting buyers from fraud and project delays.

Q. How do I avoid hidden charges?

A. Clarify all costs upfront, including taxes, maintenance, and escalation clauses, to avoid surprises.

Q. Can I inspect the property during construction?

A. Yes, and it’s highly recommended to ensure quality aligns with promises.