The DLC rate in Rajasthan refers to the minimum value fixed by the state government for property registration. DLC stands for District Level Committee. These rates are used to calculate stamp duty and registration charges during property transactions.

As of 2026, the DLC rates notified in 2025 continue to apply, since no statewide revision has been announced. Checking the DLC rate before any property transaction helps avoid valuation issues and registration delays.

Table of Contents

What the DLC Rate Indicates

The DLC rate represents the lowest value at which a property can legally be registered. If a property is purchased at a higher price, stamp duty is calculated on the actual transaction value. If the transaction value is lower, stamp duty is calculated based on the DLC rate.

This system helps maintain consistency in property valuation and ensures uniform tax collection across districts.

Who Decides DLC Rates in Rajasthan

DLC rates are decided by the District Level Committee under the Rajasthan Registration and Stamps Department. The committee reviews local property trends, development activity, and infrastructure changes before finalizing rates.

Each district publishes its own DLC rates, which is why values differ across cities and towns.

Current DLC Rates in Rajasthan As of 2026

As per available records, DLC rates revised in 2025 remain applicable in early 2026.

DLC Rates in Major Cities (Per Sq Ft)

Jaipur

Residential: ₹90,000 to ₹1,25,000

Commercial: ₹90,000 to ₹1,25,000

Jodhpur

Residential: ₹4,600

Commercial: ₹9,600

Kota

Residential: ₹4,000

Commercial: ₹8,000

Udaipur

Residential: ₹5,000

Commercial: ₹10,000

Actual rates may vary within the same city depending on locality, road access, and land use.

How to Check the Current DLC Rate in Rajasthan Online

The DLC rate, also known as the District Level Committee rate, is a critical factor in determining the minimum property valuation for registration purposes in Rajasthan. Whether you’re planning to buy, sell, or register a property, knowing the DLC rate ensures transparency and compliance with legal guidelines. This article will walk you through understanding, finding, and verifying the current DLC rate in Rajasthan.

- Visit the Official Revenue Department Portal: Rajasthan’s government maintains an updated database of DLC rates. Start by visiting the Revenue Department’s official website.

- Navigate to the DLC Rate Section: Look for the “DLC Rate” or “Property Valuation” section on the homepage.

- Select the District: Choose the district for which you want to check the DLC rate.

- Choose the Area Type: Specify whether the area is Urban or Rural.

- Select Specific Details: Depending on your selection, choose the appropriate SRO (Sub-Registrar Office), Village, or Colony.

- Enter Captcha and Proceed: Fill in the captcha code accurately and click on “Show Results”.

- View DLC Rates: The platform will display the DLC rates based on your selections.

Importance of Checking the DLC Rate

Checking the DLC rate in Rajasthan is important for buyers and sellers of property because it helps ensure fair valuation and prevents unexpected costs. DLC stands for District Level Committee, and the rates are set by the Rajasthan government.

- Accurate Property Valuation: Avoid discrepancies in property pricing.

- Compliance with Legal Standards: DLC rates form the basis for calculating stamp duty and registration fees.

- Transparent Transactions: Both buyers and sellers benefit from standardized pricing.

- Avoidance of Penalties: Underreporting property values can lead to legal issues and fines.

- Fair valuation: DLC rates ensure that properties are valued fairly and prevent discrepancies during transactions.

Where to Find the Current DLC Rate in Rajasthan?

Rajasthan’s Revenue Department and local authorities provide updated DLC rates. Here are the most common sources:

- Official Government Websites: The Department of Revenue and local district portals.

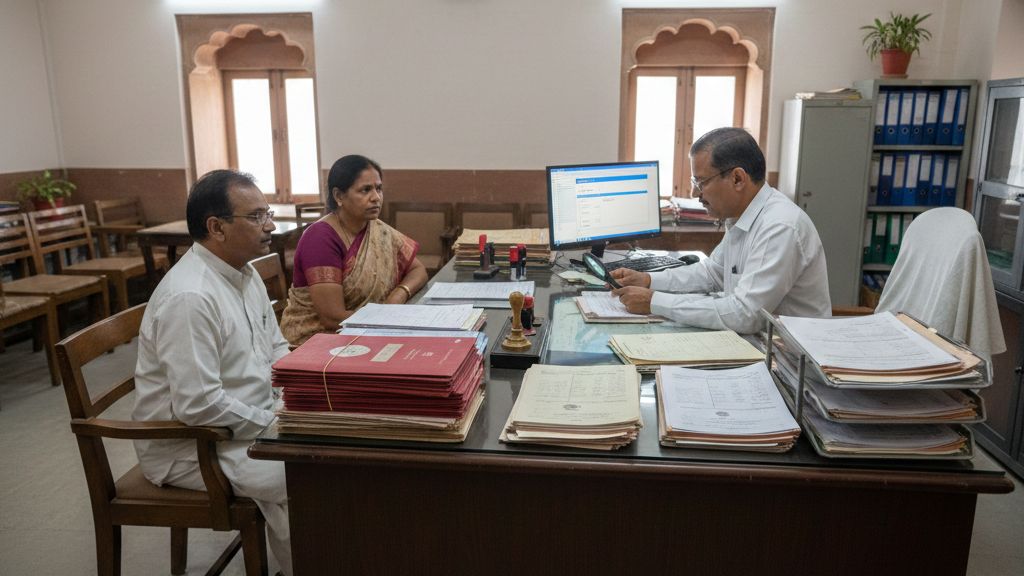

- Sub-Registrar Offices: Visit the local Sub-Registrar Office for physical records.

- Online Platforms: Many districts have digitized their records, accessible online.

Offline Methods to Check DLC Rates in Rajasthan

Offline methods to check DLC rates in Rajasthan include visiting the nearest district collector’s office or revenue department. Alternatively, you can also consult with local real estate agents or property valuation experts for accurate information on DLC rates in the region. It is important to verify the DLC rates through multiple sources to ensure accuracy. Additionally, you can also inquire with residents or property owners for insights on current DLC rates in Rajasthan.

Difference Between Interior and Road-Facing DLC Rates

DLC rates differ based on a property’s position within a locality. Road-facing properties generally have higher DLC rates because of better access and usability. Interior properties usually have lower rates due to limited access.

This distinction applies to both residential and commercial properties.

Why DLC Rates Matter in Property Transactions

Checking the DLC rate before registration helps both buyers and sellers.

- Ensures correct stamp duty calculation

- Avoids objections during registration

- Helps confirm government-recognized property value

- Supports loan documentation

- Reduces disputes over valuation

Registering a property below the DLC rate may result in additional scrutiny.

Factors That Influence DLC Rates in Rajasthan

Several local factors affect DLC rate determination.

- Road connectivity

- Availability of public infrastructure

- Proximity to markets or commercial areas

- Urban development and expansion

- Type of land use

Areas with better access and facilities usually have higher DLC rates.

Offline Methods to Verify DLC Rates

If online access is not available, DLC rates can be checked offline.

- Visit the local Sub-Registrar Office

- Contact the district revenue office or Tehsildar

- Consult licensed property agents

Offline verification is helpful when confirming locality-specific changes.

How to Calculate Property Value Using DLC Rate

Property value for registration is calculated using the DLC rate.

Formula:

Property Value = DLC Rate × Property Area

Example

If the DLC rate is ₹5,000 per sq ft and the property size is 1,000 sq ft,

the calculated value will be ₹50,00,000.

This value is used to calculate stamp duty and registration fees.

Conclusion

Checking the current DLC rate in Rajasthan is a necessary step before any property transaction. Since 2025 rates continue to apply in 2026, buyers and sellers should verify the latest figures using the official E-Panjiyan portal or local registration offices. Accurate DLC information helps ensure proper valuation and smooth registration.

| Also read Digital Land Records Process in E Khata Karnataka The evolution of property management systems has taken a transformative leap with E Khata Karnataka, a digital initiative designed to streamline property records and promote transparency. Governed by the Bruhat Bengaluru Mahanagara Palike (BBMP) and other municipal bodies, this system is pivotal in urban development and real estate regulation. Top Reasons to Invest in Dwarka Mor Project, West Delhi West Delhi, known for its dynamic real estate market, has witnessed substantial growth in recent years. Among its many promising locales, Dwarka Mor stands out as a prime investment destination. CG Bhuiyan Portal: How to Check Land Records Online in Chhattisgarh? The CG Bhuiyan portal is a digital platform launched by the Chhattisgarh government to provide easy access to land records for citizens. By visiting the portal, individuals can search for their land records by entering details such as district, tehsil, village, and Bhuyian Khasra Khata number. |

Frequently Asked Questions

Q. How often are DLC rates updated?

A. DLC (District Land Committee) rates in Rajasthan are updated annually or as needed based on market conditions and government policies.

Q. Can I negotiate the DLC rate?

A. No, the DLC rate is a fixed government benchmark and cannot be negotiated.

Q. What happens if the market value exceeds the DLC rate?

A. If the market value is higher, the stamp duty will be calculated on the higher value.

Q. Are DLC rates the same for all property types?

A. No, DLC rates vary depending on the property type, location, and other factors.

Q. Can I check the District Land Committee rate for free?

A. Yes, accessing District Land Committee rates online or from government offices is typically free.

Q. Do DLC rates include GST?

A. No, DLC rates are separate from GST, which applies to under-construction properties.