Introduction

If you own a house, shop, or any other property in Pune, you need to pay property tax every year to the Pune Municipal Corporation (PMC). This tax helps the local body maintain roads, drainage, gardens, streetlights, and other public facilities. The amount you pay depends on the size, type, and location of your property. In this article, we’ll look at everything you need to know about the Pune Municipal Corporation property tax for 2025, including new rates, how to pay, deadlines, and ways to save on your tax bill.

Table of Contents

Overview of Property Tax Under Pune Municipal Corporation

Property tax is a local tax collected by the Pune Municipal Corporation (PMC) from property owners within the city limits. It applies to all kinds of properties — residential, commercial, industrial, and open plots. The revenue from this tax is used to improve local services such as water supply, waste management, and street maintenance.

PMC revises its tax structure from time to time. For 2025, the corporation has updated its property tax rates and introduced online facilities to make payments easier for citizens.

Key Changes in 2025 Tax Slabs and Rates

For the 2025–26 financial year, PMC has made some changes in the tax calculation slabs. The updates mainly affect commercial properties and premium residential zones.

- Residential properties: The base rate has seen a minor revision in high-value areas like Kothrud, Baner, and Koregaon Park.

- Commercial properties: A slightly higher rate is now applicable for shops and offices located in major business districts.

- Green buildings: PMC continues to offer rebates for properties with rainwater harvesting, solar panels, or waste management systems.

The new rates are designed to ensure fair contribution while encouraging environment-friendly construction.

How Property Tax Is Calculated: Methodology & Formula

PMC uses the Annual Rateable Value (ARV) method to calculate property tax. The tax amount depends on:

- Property area (in sq. ft.)

- Type of property (residential, commercial, or vacant land)

- Age of the property

- Usage type (self-occupied or rented)

- Location and zone (central, suburban, or fringe area)

Formula:Property Tax = Tax Rate x Annual Rateable Value (ARV)

The ARV is determined by estimating the yearly rental value of your property, even if it’s self-occupied. For example, if your flat’s ARV is ₹1,00,000 and the tax rate is 15%, your annual property tax will be ₹15,000.

Residential vs Commercial Property Tax Differences

The main difference between residential and commercial property tax lies in the rate.

- Residential properties generally have lower tax rates.

- Commercial and industrial properties attract higher rates since they generate business income and place a greater load on civic infrastructure.

For instance, a residential apartment in Kharadi may have a lower tax compared to a nearby office building of the same size.

Concessions & Rebates: Senior Citizens, Green Buildings & More

PMC provides several rebates to make property tax fair for all categories of owners:

- Senior citizens get a small percentage reduction in the total tax amount.

- Green buildings with solar panels or rainwater harvesting get up to 10% discount.

- Disabled property owners and war widows are also eligible for partial waivers.

- Early payers (those who pay before the deadline) can get an additional 5% rebate.

These rebates are automatically applied if the property qualifies and relevant documents are submitted.

Payment Deadlines & Penalties for Late Payment

PMC usually divides the tax collection into two halves, one payable before June 30, and the second before December 31. If you delay the payment, a penalty of 2% per month is charged on the outstanding amount. It’s best to clear dues before the first deadline to avoid fines and to enjoy early payment discounts.

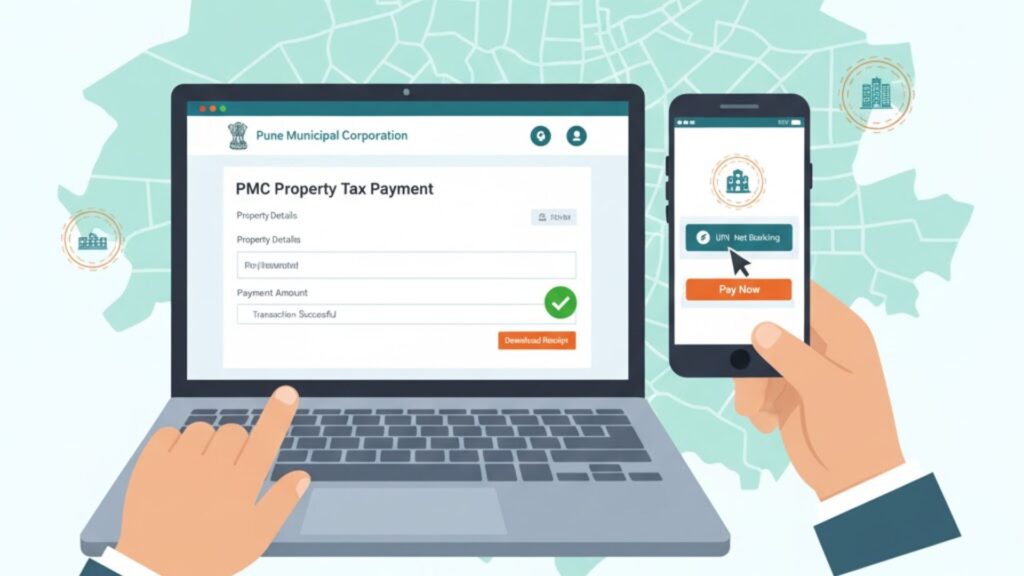

Online Payment Through PMC Portal: Step-by-Step Guide

PMC has made it easy to pay your tax online through its official website. Here’s how:

- Visit PMC Portal

- Enter your Property Code or Owner Name.

- Verify your property details.

- Check the tax amount shown on the screen.

- Choose a payment option — debit card, credit card, UPI, or net banking.

- Complete the payment and download the receipt for your records.

Online payment helps you avoid queues and saves time.

Alternative Payment Methods: Banks, Mobile Apps & Customer Care

Besides the online method, you can pay your PMC property tax through:

- Authorized banks such as HDFC, ICICI, and Bank of Maharashtra

- Mobile apps like Paytm, Google Pay, and PhonePe (if linked with PMC)

- PMC help centers and Citizen Facilitation Kiosks across the city

You can also contact PMC’s property tax department for assistance if you face any technical issues during payment.

Documents Required for Tax Assessment & Payment

If you’re paying for the first time or updating your property details, keep the following documents handy:

- Property tax bill or property code number

- Sale deed or ownership proof

- Building completion certificate (for new properties)

- Old receipts (for payment history)

- Aadhaar card and PAN card for verification

These documents help PMC verify ownership and assess tax correctly.

Appeals and Grievance Redressal Procedure

If you believe your tax amount has been wrongly calculated, you can raise an appeal with PMC’s Assessment and Collection Department. File a written request with supporting documents such as previous bills, ownership proof, or valuation certificates. PMC will review and make corrections if required. You can also submit complaints online via the PMC grievance portal.

How Property Tax Funds Are Utilized by the Municipality

The money collected through property tax goes toward improving city infrastructure — building roads, repairing drainage lines, maintaining gardens, and managing solid waste. It also supports public services like fire safety, water supply, and cleanliness drives. In short, paying property tax ensures better local development and quality of life.

Tips to Reduce Your Property Tax Burden

- Install solar panels or rainwater harvesting systems to get rebates.

- Pay early to enjoy the early-bird discount.

- Cross-check your property type and usage — sometimes incorrect entries increase the payable tax.

- Update property records with accurate area and zone details to avoid overcharges.

Common Issues & Troubleshooting Payment Errors

Some users face issues such as “payment failed” or “record not found” during online transactions. In such cases:

- Wait for 24 hours; sometimes the payment reflects later.

- Recheck your Property Code for typing errors.

- If double payment occurs, PMC refunds the extra amount within a few weeks.

- You can contact the PMC helpline or visit the nearest office for help.

Comparison with Property Tax Rates in Mumbai & Bengaluru

Compared to Mumbai, Pune’s property tax rates are moderate. Mumbai uses a capital-value-based system, which can result in higher bills for premium properties. Bengaluru’s BBMP follows a similar unit area value system but offers higher rebates for eco-friendly homes. Pune’s system remains simpler and more predictable for homeowners.

Future Outlook: Proposed Changes Beyond 2025

PMC plans to move toward a GIS-based property mapping system to identify unregistered properties and improve transparency. Digital records and QR-coded bills are also expected in the coming years. These updates aim to make tax payment smoother and more accurate.

Conclusion

Paying Pune Municipal Corporation property tax is a simple but important civic duty. It keeps the city running and helps maintain essential services for everyone. With the new online system and updated 2025 tax structure, property owners in Pune can manage their payments easily and avoid last-minute hassles. Whether you own a small flat or a commercial unit, staying informed and paying on time ensures peace of mind and supports Pune’s growth.