When buying or selling property, ensuring legal clarity is crucial. One of the most important documents in this process is the Encumbrance Certificate (EC). It acts as proof that a property is free from legal liabilities such as unpaid loans, mortgages, or other claims. Understanding this document can help protect buyers from future disputes and financial losses.

Table of Contents

- What Is an Encumbrance Certificate?

- Why an Encumbrance Certificate Is Important for Property Buyers?

- Key Information Found in an Encumbrance Certificate

- How to Apply for an Encumbrance Certificate Online and Offline?

- How to Verify and Interpret an Encumbrance Certificate?

- Common Issues Related to Encumbrance Certificates and How to Resolve Them

- Frequently Asked Questions

What Is an Encumbrance Certificate?

An Encumbrance Certificate is a legal document that certifies whether a property is free from any monetary or legal liabilities, such as loans, mortgages, or claims. Issued by the local Sub-Registrar’s Office, the EC contains a record of all registered transactions related to a particular property over a specified period.

In simpler terms, the certificate tells you if the property is encumbered tied up with any financial obligation or if it has a clean title.

Why an Encumbrance Certificate Is Important for Property Buyers?

Purchasing a property without proper verification can lead to severe complications. Here’s why obtaining an EC for property is essential:

- Valuable for Resale: A clean EC boosts the resale value of the property and increases buyer confidence.

- Ensures Clear Title: The EC confirms that the seller has full legal ownership and that the property isn’t mortgaged or disputed.

- Avoids Legal Complications: It protects buyers from buying a property with hidden debts or pending litigations.

- Mandatory for Loans and Registration: Financial institutions require an EC before approving a home loan, and it may be needed during property registration.

- Proof of Ownership: It serves as a legitimate proof of ownership for legal and financial purposes.

Key Information Found in an Encumbrance Certificate

A typical encumbrance certificate contains:

- Name of the property owner(s)

- Property description (location, boundaries, survey number, extent)

- List of transactions: sales, mortgages, leases, gifts, etc.

- Duration of the certificate (usually 12–30 years)

- Type of encumbrances (if any)

- Document numbers and registration dates

- Statement indicating “No Encumbrance” if applicable

This information helps buyers conduct a proper encumbrance check and ensures that the land records in India are in order.

How to Apply for an Encumbrance Certificate Online and Offline?

You can apply for an encumbrance certificate online or through offline channels, depending on the state government’s facilities.

Online Application

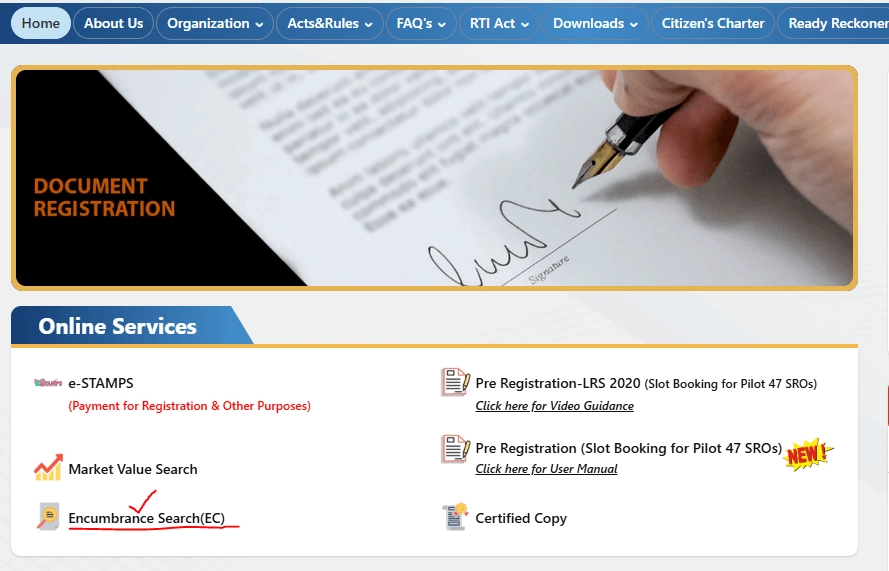

Many states in India offer EC services through their respective registration departments or land records portals. Here’s a general process:

- Visit the official website (e.g., IGR, Bhoomi, Meebhoomi, etc.).

- Choose “Apply for Encumbrance Certificate” under property services.

- Fill in required details:

- Property address

- Survey number

- Registration period

- Applicant information

- Upload any necessary documents (ID proof, sale deed copy, etc.).

- Pay the application fee online.

- Submit and receive an acknowledgment number.

- The EC is usually issued within 5–10 working days and can be downloaded.

Offline Application

If online services aren’t available:

- Visit the Sub-Registrar’s Office where the property is registered.

- Fill out Form 22 (application for EC).

- Submit:

- Property details

- Copies of previous deeds

- Applicant’s ID proof

- Pay the applicable fee.

- Collect the certificate in person after processing.

How to Verify and Interpret an Encumbrance Certificate?

Once you receive the EC, carefully review it to ensure accuracy:

Key Points to Verify:

- Owner name(s): Should match the seller’s identity.

- Property description: Must be accurate in dimensions, survey numbers, etc.

- Encumbrance status: A “Nil EC” indicates no liabilities.

- Transaction history: Check all transactions for authenticity and relevance.

- Duration: Ensure it covers at least 13–30 years (or longer if needed).

Understanding a Nil EC vs. Detailed EC:

- Nil Encumbrance Certificate: States that no transactions or encumbrances are registered during the mentioned period.

- Detailed EC: Lists transactions such as sales, loans, and releases of mortgages.

Use this information to confirm property ownership proof and identify any potential red flags in the title.

Common Issues Related to Encumbrance Certificates and How to Resolve Them

Despite the EC’s reliability, certain issues may arise:

Incomplete Records

- Sometimes, not all transactions are recorded due to unregistered documents.

- Solution: Ask the seller for unregistered documents (e.g., family settlements, wills) and cross-check with local authorities.

Incorrect Property Details

- Mistakes in survey numbers or owner names.

- Solution: Request corrections from the Sub-Registrar by submitting supporting documents.

Non-Availability of Online EC

- Some areas may not have digitized records.

- Solution: Visit the Sub-Registrar’s Office and apply offline.

Delay in Issuance

- Due to high demand or system issues.

- Solution: Follow up with the concerned authority or escalate through the RTI route if needed.

Conclusion

An encumbrance certificate is a non-negotiable part of due diligence for any property verification process. It assures a clear title, provides transparency about the property’s legal standing, and protects you from potential fraud or financial liabilities.

Whether you are buying, selling, or applying for a loan against property, always conduct a proper encumbrance check. Obtain the EC through official land records India portals or registrar offices and scrutinize it carefully to ensure peace of mind.

More Information

Stay updated on the latest developments in the real estate industry by following the openplot information.

Our platform offers valuable insights and updates, along with informative articles and market reports. Openplot.com helps find or sell a home, which is a significant milestone.

Frequently Asked Questions

Q. How can I apply for an encumbrance certificate online?

A. You can apply through your state’s official land records or registration website. For example, states like Karnataka (Bhoomi), Andhra Pradesh (Meebhoomi), and Tamil Nadu (TNREGINET) offer online services. Fill in property details, upload documents, and pay the fee to receive the EC digitally.

Q. Is an encumbrance certificate mandatory for property registration?

A. While not always mandatory, an EC is strongly recommended before registration to ensure the property has a clear title. Some states or banks may require it to approve loans or complete registration.

Q. How do I check if a property has any encumbrances?

A. Obtain an encumbrance certificate for a period of 13–30 years. A “Nil EC” means no liabilities. You can also check property registration documents and consult local legal experts to ensure the property is free from encumbrance.