Introduction

AP market value is a crucial reference point for property transactions in Andhra Pradesh. It represents the official government-assessed value of land and buildings used for calculating stamp duty, registration charges, and other legal and financial purposes. Whether you are buying, selling, or verifying property details, knowing how to check the AP market value through the IGRS system helps ensure transparency and compliance.

This article explains the meaning of AP market value, how it is determined, and the step-by-step process to check IGRS market value online and offline for the financial year 2025–26.

What Is IGRS Andhra Pradesh?

IGRS Andhra Pradesh is an integrated digital platform operated by the Andhra Pradesh Registration and Stamps Department. The portal was introduced to bring transparency and efficiency to property-related services across the state.

Through the IGRS platform, users can:

- Check the official market value of land and buildings

- Search and download Encumbrance Certificates (EC)

- View stamp duty and registration fee details

- Track property registration applications

By providing verified government data online, IGRS reduces the need for intermediaries and physical visits to registration offices.

What Is AP Market Value?

AP market value refers to the minimum value fixed by the government for registering a property in Andhra Pradesh. This value is determined by the Registration and Stamps Department and serves as the legal base price for:

- Property registration

- Stamp duty and registration fee calculation

- Court cases and legal documentation

- Bank loans and financial assessments

Even if the actual sale price is lower, registration must be done at or above the notified AP market value.

How Is Market Value Determined in Andhra Pradesh?

The AP market value of a property is calculated based on multiple parameters assessed by the government:

- Location: Urban areas, municipal zones, and growth corridors typically have higher values

- Property Type: Agricultural land, residential plots, apartments, and commercial properties are assessed differently

- Infrastructure Development: Proximity to highways, metro lines, IT parks, schools, and hospitals

- Demand and Supply: Areas with higher demand witness periodic value revisions

- Government Notifications: Annual or periodic revisions issued to reflect market trends

These factors ensure that market values remain aligned with prevailing real estate conditions.

How to Check AP Market Value 2025–26 Online

The easiest and fastest way to check AP market value is through the official IGRS portal.

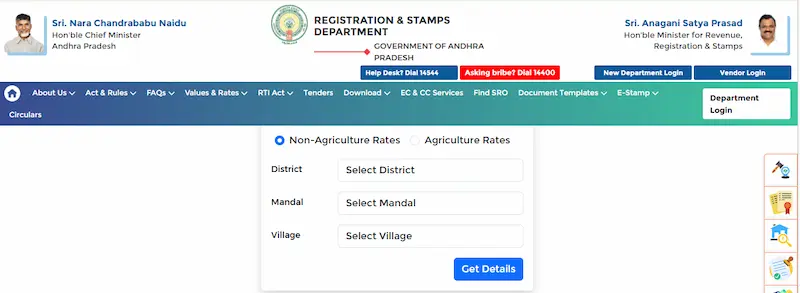

Steps to Check AP Market Value Online

- Visit the official website of the Andhra Pradesh Registration and Stamps Department

- Click on Market Value Assistance

- Select the property type (land, residential, or commercial)

- Choose district, mandal, and village from the dropdown options

- Submit the details to view the official AP market value

The system instantly displays the government-notified value applicable for registration.

How to Check AP Market Value 2025–26 Offline

Offline verification is useful for individuals who require physical confirmation or certified information.

Method 1: Sub-Registrar Office

- Visit the Sub-Registrar Office where the property is located

- Provide details such as survey number, village, and property type

- Refer to the officially maintained market value registers for FY 2025–26

Method 2: Revenue Office

- Approach the Mandal Revenue Officer (MRO) or Revenue Inspector

- Submit ownership proof and identification documents

- Obtain official market value information applicable to the property

Offline methods are commonly used for legal disputes and institutional verification.

Documents Required to Check AP Market Value

For offline verification, keep the following documents ready:

- Sale deed or agreement of sale

- Encumbrance Certificate (EC)

- Property tax receipts

- Proof of identity (Aadhaar card or PAN card)

These documents help officials accurately locate and verify property records.

Difference Between Market Value and Sale Price

| Aspect | AP Market Value | Sale Price |

|---|---|---|

| Defined by | Government | Buyer and Seller |

| Purpose | Registration & stamp duty | Transaction agreement |

| Flexibility | Fixed | Negotiable |

| Legal minimum | Yes | No |

Stamp duty and registration fees are calculated on the higher of the market value or sale price.

Conclusion

Understanding the AP market value for FY 2025–26 is essential for anyone involved in property transactions in Andhra Pradesh. The government-notified market value serves as the legal foundation for calculating stamp duty, completing registrations, and avoiding disputes related to undervaluation. By using the IGRS Andhra Pradesh portal or verifying details through local registration offices, property buyers, sellers, and investors can ensure accuracy and compliance with current regulations.

Staying informed about the latest market value guidelines helps you make confident, well-documented real estate decisions. For ongoing updates, verified property information, and expert guidance on land and property valuation in Andhra Pradesh, refer to trusted resources such as Openplot.

| Also read What Is the Sales Agreement Format and Process? A contract of sale is the legal form you agree to start the property process when you buy a property or home. A Sales Agreement format usually includes details such as the parties involved. A description of the property or home being sold, the price and any terms and conditions. AP IGRS: Andhra Pradesh Stamps and Registration Deed Details for Land Andhra Pradesh Stamps and Registration Department plays a crucial role in the state’s registration of land properties. It is responsible for maintaining accurate records of property transactions and ensuring transparency and legality in real estate dealings. The department also collects stamp duty on property transactions to generate revenue for the state government. The Importance of Conveyance Deeds in Real Estate Transactions In the world, protecting one’s rights is the most important thing. Similarly, when it comes to immovable property, a deed declaring a conveyance does the job. A conveyance deed is a legal document used to transfer the title of property from one person to another through gift, exchange, lease, or mortgage. |

Frequently Asked Questions

Q. How often is the AP market value updated?

A. The market value is periodically revised by the Andhra Pradesh Revenue Department to reflect current trends.

Q. Can I access the market value for free?

A. Yes, basic property valuation searches on the IGRS portal are free of charge.

Q. What if my property’s market value isn’t listed correctly?

A. You can file a query with the local sub-registrar’s office or through the IGRS grievance system.

Q. Is there a mobile app for IGRS Andhra Pradesh?

A. Yes, the IGRS system is accessible via mobile-friendly platforms for added convenience.

Q. How is market value different from guideline value?

A. Market value represents the actual transaction worth, while guideline value is the government’s baseline estimate.

Q. Can NRIs use the IGRS portal?

A. Absolutely! NRIs with property interests in Andhra Pradesh can access the portal remotely.