Introduction

Are you planning to buy or sell a property in Bihar and wondering about the stamp duty and registration charges involved? Look no further! In this blog post, we will guide you through the process of property registration in Bihar. Including the property registration Bihar stamp duty and registration charges applicable.

Table of Contents

- What is Stamp Duty?

- Stamp Duty and Registration Charges in Bihar

- Importance of Property Registration in Bihar

- Documents Required for Property Registration in Bihar

- Collection of Documents Before Property Registration Bihar Process

- Process of Registration Property in Bihar

- Online Property Registration

- Frequently Asked Questions

Individuals involved in property transactions in Bihar must comply with the registration. requirements to avoid any legal complications. By following the Registration Act of 1980. Both parties can have peace of mind knowing that their rights are protected under the law. The registration process ensures that the property transaction is legally recognized and binding. It also provides a clear record of ownership and helps prevent disputes in the future.

What is Stamp Duty?

Stamp duty is a type of tax levied by the state government on the transfer of property from one person to another. It is a mandatory fee that needs to be paid to legally register the property in your name. The stamp duty rates vary from state to state and are based on the value of the property being transferred. The amount of stamp duty payable can significantly impact. The overall cost of purchasing a property, so it’s important to factor this into your budget.

Failure to pay the required stamp duty can result in legal consequences. May delay or prevent the registration of the property in your name. It is crucial to research and understand the stamp duty rates in your specific state. Before, proceeding with any property transactions. Consulting with a legal professional or real estate agent can help ensure that you are fully informed. Prepared for any financial obligations related to stamp duty.

Stamp Duty and Registration Charges in Bihar

Stamp Duty and Registration Charges in Bihar vary depending on the value of the property being registered. These charges are typically calculated as a percentage of the property’s market value. With higher-value properties attracting higher fees. It is important for individuals looking to purchase property in Bihar. To factor in these additional costs when budgeting for their purchase.

- Women: 5% of the property value

- Men: 6% of the property value

- Minimum Registration Charges: INR 200

Importance of Property Registration in Bihar

Property registration in Bihar is crucial as it provides legal recognition and ownership rights to the property owner. It also helps in preventing any disputes or fraud related to the property in the future. Registered properties can be used as collateral for loans and can be easily transferred or inherited by legal heirs. Furthermore, property registration in Bihar ensures that the government. It can levy property taxes accurately.

The property owner can avail of various government schemes and benefits. It also contributes to the overall transparency and efficiency of the real estate market in the state. So, property registration in Bihar is essential for both the property owner. The government maintains a clear record of ownership and transactions.

It also plays a significant role in boosting investor confidence. Promoting economic growth in the state. Property registration in Bihar serves as a key mechanism for maintaining legal clarity. To promote economic development in the real estate sector. Property owners must comply with registration requirements to ensure smooth transactions. Avoid any future legal disputes.

Documents Required for Property Registration in Bihar

When you buy or sell a property, registration must be done in Bihar at that time. To register a property in Bihar, you will need the following documents:

- Sale deed

- Identity proof of the buyer and seller

- Address proof of the buyer and seller

- PAN card

- Passport size photographs

- NOC from the builder or society

- Encumbrance certificate

- Receipts of stamp duty and registration charges paid

Collection of Documents Before Property Registration Bihar Process

Property registration in Bihar is a very simple process. The first step is to obtain the necessary documents such as proof of ownership and identity. Once you have collected all the required documents, you can submit your application. The local registrar’s office for verification and approval. It consists of the following steps:

Before starting the registration process, you need to collect the following documents:

- Aadhaar card and PAN card of seller and buyer

- Seller’s Sale Deed

- Original property documents (such as registry, and transfer documents)

- Documents containing the market value of the property

- Two passport-size photographs of the seller and buyer

- Property Tax Receipts (if applicable)

Payment of Stamp Duty and Registration Fee

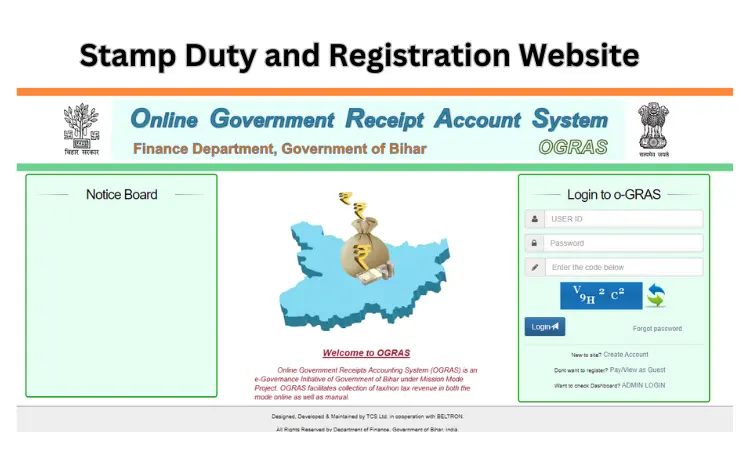

You have to pay stamp duty and registration fees depending on the value of the property. You can make payments through online mode (OGRAS portal) or net banking. It is important to ensure that the stamp duty and registration fees are paid on time to avoid any legal complications. It is advisable to keep all payment receipts and documents safe for future reference.

Attendance at Sub-Registrar Office

You have to appear in the office of the Sub-Registrar on the date fixed for registration. Both seller and buyer must be present. It is important to bring all necessary documents and identification for the registration process. Failure to appear may result in delays or complications with the transfer of ownership. It is crucial to arrive on time. Be prepared with all required paperwork to ensure a smooth registration process. It is sure to follow any specific instructions provided by the Sub-Registrar to avoid any issues.

Sub-Registration of the Property

After verification of all documents and payment of fees, the Sub-Registrar registers the property. You will receive a registered sale deed. This document serves as legal proof of ownership and should be kept in a safe place. It is important to review the sale deed carefully to ensure all details are accurate. Any discrepancies should be addressed immediately to avoid future legal issues. It is recommended to make copies of the sale deed and store them in separate locations for safekeeping.

Biometric Verifications

During attendance at the Sub-Registrar office, biometric verification (Aadhaar Card verification) of the seller and buyer will be done. This verification process is mandatory for property registration. It helps prevent fraud and ensure the authenticity of the individuals involved in the transaction.

It also helps in maintaining accurate records of property ownership. This verification process adds an extra layer of security to the property registration process. Giving both parties peace of mind. It streamlines the registration process by reducing the chances of identity theft or misrepresentation.

Process of Registration Property in Bihar

The Inspector General of Registration and Stamps (IGRS) is responsible for the entire property registration process in Bihar. This includes maintaining land records and facilitating property transactions. Ensuring compliance with relevant laws and regulations. The IGRS aims to streamline the registration process. It promotes transparency in property dealings across the state.

- The first step is to register on the official bhumijankari.bihar.gov.in website

- The portal provides circle rate details of current Minimum Value Register (MVR).

- To pay the stamp duty and registration fee, visit a separate official website. E-receipt.bihar.gov.in and follow the necessary steps to make payment. Keep the payment receipt/challan carefully. After, your challan receipt, present the same at the SRO during registration.

- Next, to book an appointment at the SRO, register by clicking on the ‘Login’ option. Then enter the necessary details to sign up on the portal.

- After logging in, you can access state registry records.

- Book the appropriate slot online at the concerned SRO for Biometric Verification.

- Seller, buyer, and two witnesses along with the required documents. Physical attendance at the scheduled appointment is required.

- The SRO will cross-check the details provided in the registration form with the original documents to approve the property registration.

- After completion of registration, the certificate will be provided online. You download this document for future reference.

Online Property Registration

The Bihar Government has launched an online registration facility to facilitate the property registration process. You can register online through the official website of the Bihar Registration Department. This initiative aims to make the property registration process more convenient and efficient for the residents of Bihar.

It allows individuals to complete the registration process from the comfort of their own homes, saving time and effort. This online registration facility helps reduce. The need for physical visits to government offices. Thus promoting social distancing during the ongoing pandemic. This initiative reflects the government’s commitment to leveraging technology to improve public services.

Conclusion

Property registration in Bihar involves paying stamp duty and registration charges. Which are essential for legally transferring ownership of the property. It is important to ensure all necessary documents are in order. Fees are paid on time to avoid any legal complications in the future. It is recommended to seek guidance from a legal professional or real estate agent to navigate the process smoothly. Failure to comply with property registration requirements can result in penalties or even legal disputes.

| Also read Latest Stamp Duty Calculator and Registration Charges in India The Finance Ministry proposed a new bill to replace the Indian Stamp Act 1899. The draft bill refers to various provisions considered outdated or redundant in the existing law. Hence, digital signatures and electronic payments have proposed a new bill. Stamp Duty Has Been Increased in Tamil Nadu for 20 Legal Instruments The Tamil Nadu government has officially announced the increase in stamp duty on 23 legal instruments. The decision aims to increase revenue for the state government and ensure compliance with legal procedures. The notification includes the new rates. Stamp Duty and Registration Charges in Kerala in 2024 According to the Registration Act of 1905, homebuyers in Kerala have to pay stamp duty and registration fees to become legal owners. The property should be registered after purchase. The Kerala Registration Department was responsible for levying and collecting stamp duty and registration charges. |

Frequently Asked Questions

Q. How is stamp duty calculated in Bihar?

A. Stamp duty in Bihar is calculated based on the market value of the property or the agreement value, whichever is higher. It is typically around 5-7% of the property value. Additionally, registration charges are also applicable when registering a property in Bihar, which are usually around 1% of the property value.

Q. How much stamp duty do I need to pay for property registration in Bihar?

A. The stamp duty rates and registration charges vary depending on the type and value of the property being registered. You can visit the official website of the Bihar government for accurate information.

Q. Is the official website of IGRS Bihar also useful for land records?

A. Yes, the IGRS Bihar website also has land records.