Introduction

Property tax in Villupuram can be paid online through the official website of the Villupuram Municipality Property Tax. Residents can also visit the municipality office in person to pay their property tax. It is important to have the necessary documents. Such as property details and assessment numbers. Ready before making the payment. Residents can also inquire about any discounts or exemptions. They may be eligible for this while paying their property tax. Openplot explains the paying process and calculates.

Table of Contents

- How to Pay the Property Tax in Villupuram?

- Calculate of Property Tax Villupuram

- What Are the Factors for the Property Tax in Villupuram?

- How to Pay Villupuram Municipality Property Tax Online?

- How to Pay Villupuram Municipality Property Tax Offline?

- Property Tax Mutation Process

- Frequently Asked Questions

Residents of Villupuram, Tamil Nadu can pay their property tax. To the Tamil Nadu Government through various online and offline payment methods. According to the latest updated news, citizens must pay property tax for the second half of 2024-25 by 31 October 2024. If you pay property tax on time you will get an incentive of five percent (up to Rs. 5,000). Property should pay official online payments and offline payments on time. You get the reduction on the next tax payments.

How to Pay the Property Tax in Villupuram?

To pay Villupuram property tax, you can visit the official website of Municipality. Navigate to the online payment portal. Once there, enter your property details and make the payment using the method of your choice. Like credit cards or net banking. If you prefer to pay in person. You can visit the Municipality office and pay your property tax dues at the designated counter.

You can pay your Villupuram property tax through authorized bank branches or even through mobile payment apps. Be sure to keep a record of your payment receipt for future reference. If you do not delay paying the property tax, get more benefits.

Calculate of Property Tax Villupuram

Commissioner of Municipal Administration, Tamil Nadu provides a tax calculator on its official portal to all citizens. The residents to easily estimate the property tax. They owe based on the property’s location, size, and type. Users can also access information on tax rates. And payment deadlines through the portal.

The tax calculator provides a breakdown of how the property tax is calculated. Giving residents transparency into the process. This simplifies the tax payment process. However, property owners should pay on-time property tax. It is a property owner’s responsibility. Property tax Villupuram is assessed based on Annual Rental Value (ARV). Here is the Property tax formula to calculate ARV:

| Annual rental value = (Area x zone rate x factor indicator x building usage rate) x 12 |

What Are the Factors for the Property Tax in Villupuram?

Factors for the property tax in Villupuram include the market value of the properties, any exemptions or deductions, and the taxes rate set by the local government. The size and type of property, as well as any improvements made to it, can also impact the final tax amount. Here are several parameters while calculating property tax.

- Name of municipality or corporation

- Area

- Locality

- The street

- Ward

- Property type

- Building location

- Building area

- ULB

- Approved building area

- Construction age

- Date of approval of building plan

- Floor no

- Built-up Area (Sq. Ft.)

- Zone rate

- Annual rental value

- Land value

How to Pay Villupuram Municipality Property Tax Online?

Properties-owners can pay Municipality property tax online through the official website. Taxpayers must use their Property Assessment Number for successful tax payments. It is mandatory at the time of payment of tax. Here is the step-by-step property tax online process.

- Visit the official Municipality Property Tax Online website.

- Click on the website link on the left side of the page and you will be taken to a new page.

- A new page will be displayed on the screen.

- After, click on the ‘Quick Payment‘ link.

- Next, click on the ‘Property Tax’ link.

- Enter your assessment number and click the search button to complete the property tax payment.

How to Pay Villupuram Municipality Property Tax Offline?

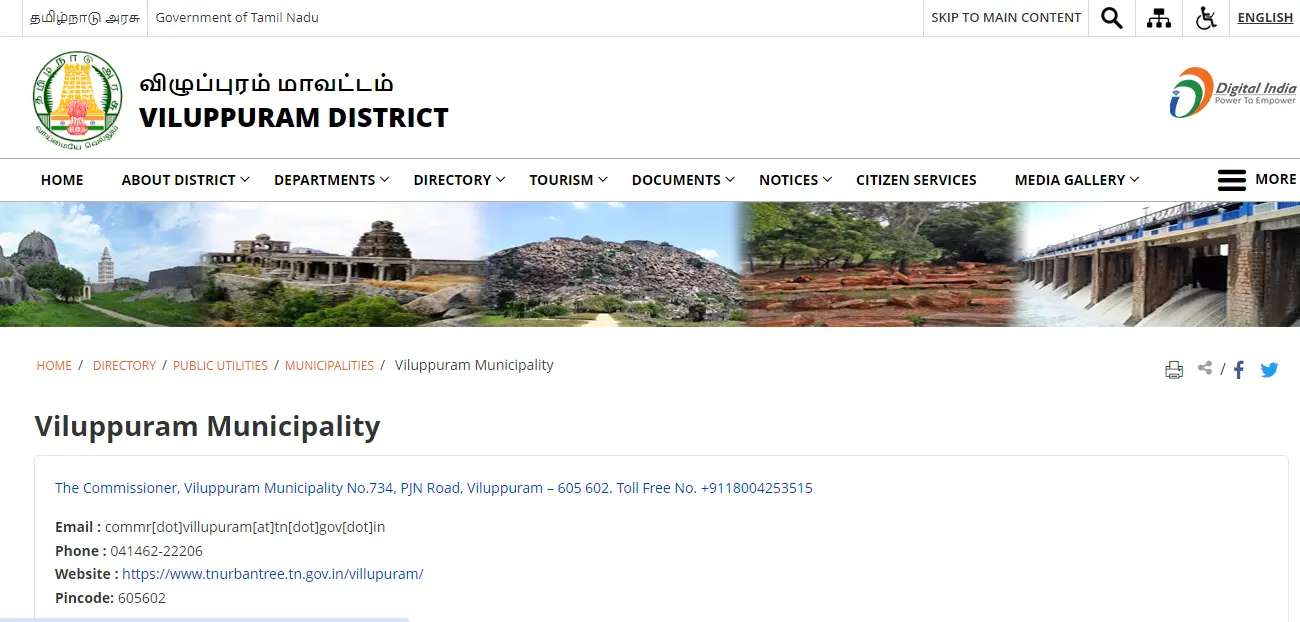

Taxpayers can visit the Municipal Office to pay property tax manually in Villupuram through offline mode. If you have any queries, you can directly ask the municipal officer. First, the documents required for payment of tax must be arranged. Fill the required information in the document. Confirm complete details with correct information. Official contact details of Villupuram Municipality are given below:

- Address: BL Municipal Commissioner, Municipal Office, No 9, Hospital Road, (New Office Building) Villupuram – 605602

- Phone: 04146 223 365

- E-mail: commr.villupuram@tn.gov.in

Property Tax Mutation Process

Properties mutation means updating the name of the new owner in the municipal records. This process usually involves submitting legal documents. Pay the local government office and any associated fees. New owner after completion of mutation. There is official recognition as the legal owner of the property.

Name transfer orders are issued within 20 days of receipt of the application. If there are any problems with the application, you will be notified immediately. You will receive an acknowledgment of your application. This is an important step in the property transfer process to ensure. The rights of the new owner are protected and legally recognized. Failure to complete the mutation may result in future problems or ownership disputes.

Conclusion

A municipality’s property tax is a key responsibility for properties owners in the area. By following the necessary steps and deadlines, residents can ensure They comply with local regulations and contribute to the development of their community. Timely payment of property tax can help avoid penalties or legal problems. It also plays a vital role in funding essential services provided by the Villupuram Municipality Property Tax.

| Also read Udaipur Municipal Corporation: A Step-by-step Guide to Property Tax Udaipur Udaipur Municipal Corporation (UMC) is responsible for collection and collection of property tax in Udaipur. The property owners must pay tax. It is the taxpayer’s responsibility. Otherwise, UMC imposes penalties on property taxpayers. How to Pay the Vellore Municipal Corporation Property Tax Payment? Vellore is a famous city in Tamil Nadu. Vellore Corporation collects property tax through its official website. You can pay Vellore Corporation property tax using the correct assessment number and other key details. Timely tax payments help you get incentives and avoid penalties. Vijayawada Municipal Corporation: How to Pay Property Tax Online? In India, citizens have to pay property and house taxes. As per the Government of India rule, every property owner has to pay property or house tax on time. Failure to pay property or home taxes can result in fines and legal consequences. |

Frequently Asked Questions

Q. What is the last date to pay property tax in Villupuram?

A. The last date for payment of properties tax for the second half of 2024-25 in Villupuram is October 31.

Q. How much is the property tax rebate by Villupuram Municipality?

A. Villupuram Municipality offers a 5% rebate (up to Rs. 5,000) for the second half payment of Villupuram property tax 2024-25 by October 31, 2024.

Q. What is the penalty for late payment of the property tax in Villupuram?

A. A penalty of around 1-2% of the outstanding amount is payable for late payment.