Introduction

The land registration process in Telangana is mandatory for all property transactions, including open plots, flats, apartments, and agricultural land. Property buyers must register the sale deed with the Telangana Registration and Stamps Department and pay applicable stamp duty and registration charges based on the notified market value. Without registration, ownership records remain incomplete, which may create difficulties during resale or future reference.

In 2026, Telangana continues to rely on a digitized land registration system, where a major part of the process can be completed online, reducing paperwork and office visits.

Table of Contents

Land Registration Process in Telangana

The Telangana land registration process follows a structured system combining online document upload and physical verification at the Sub-Registrar Office (SRO), where required.

Buyers and sellers can upload property documents online through the official portal. After document submission and fee payment, a slot can be booked for SRO verification if needed. Many registrations are now completed with minimal in-person visits, making the system more efficient.

Seeking guidance from a real estate consultant or documentation expert may help in avoiding errors during registration.

About Telangana Land Market Values 2026

As per revised market value guidelines, land and property values in Telangana have seen steady revisions in recent years. Open plots, agricultural land, and residential flats have recorded upward revisions in notified values due to demand across residential, commercial, and industrial segments.

This trend is supported by infrastructure development, improved connectivity, and increased interest from buyers and investors across urban and semi-urban regions. The market value guidelines continue to be updated under existing rules to reflect prevailing conditions.

Online Land Registration in Telangana

The online land registration system in Telangana allows users to:

- Upload property documents online

- Calculate stamp duty and registration charges

- Pay fees digitally

- Book SRO appointments

This process helps reduce delays, manual errors, and document mismatches. Online registration also improves record accuracy and transparency in property transactions.

Land Registration Fees in Telangana

| Type of Document | Stamp Duty | Registration Fee |

|---|---|---|

| Sale of flat or apartment | 4% | 0.5% |

| Sale agreement with possession | 4% | 0.5% (Min INR 5,000 – Max INR 20,000) |

| Sale agreement without possession | 0.5% | 0.5% (Min INR 5,000 – Max INR 20,000) |

| Sale agreement-cum-GPA | 5% | INR 2,000 |

Charges are calculated based on the applicable market value.

Documents Required for Land Registration in Telangana

Before visiting the Sub-Registrar Office, all documents must be uploaded online. This ensures faster verification and fewer corrections later.

Required documents include:

- Original property documents signed by both parties

- Encumbrance Certificate

- Proof of stamp duty payment (e-challan or bank challan)

- Property card

- Section 32A photo form

- Identity proof of buyer, seller, and witnesses

- PAN card

- Aadhaar card

- Address proof

- Power of Attorney (if applicable)

- Exterior photo of the property

- Pattadar passbook (for agricultural land)

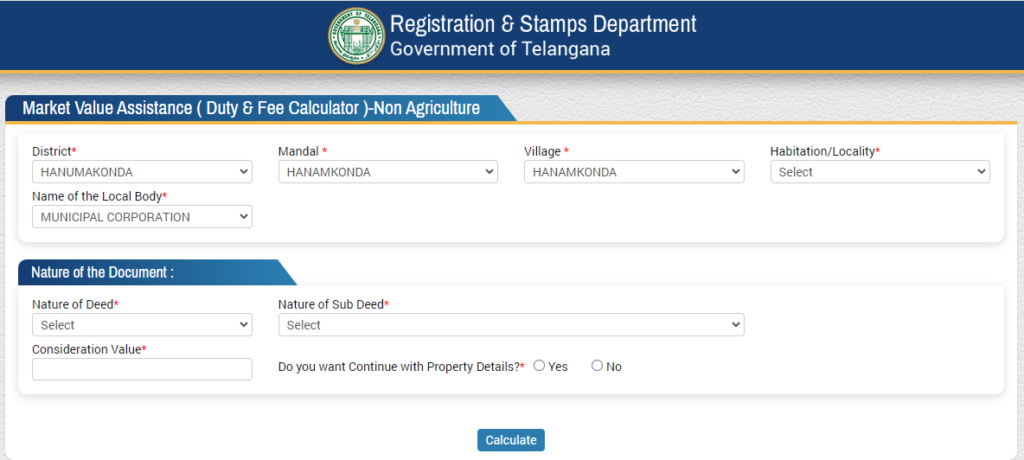

How to Calculate Stamp Duty and Registration Charges in Telangana

Property buyers can use the stamp duty calculator Telangana option available on the official portal.

Steps:

- Visit the Telangana Registration and Stamps Department website

- Select deed type and sub-deed type

- Enter consideration value

- Choose property type and construction details

- Click “Calculate” to view market value and total payable amount

The system displays stamp duty, transfer duty (if applicable), and registration fees clearly.

Land Pre-Registration Process in Telangana

Before registration, buyers should:

- Verify land ownership and property details

- Prepare documents using the Public Data Entry system

- Ensure all payments are completed

This pre-registration step helps avoid delays and document rejection during final submission.

Property Document Checklist

At the time of registration, ensure the following:

- Signed original document

- e-stamp or e-challan proof

- Land title deed copy

- Identity and address proof

- Application form

- Property photograph

- GPA/SPA documents, if applicable

Step-by-Step Land Registration Process in Telangana

- Create a login on the Telangana property registration portal

- Upload required documents

- Pay stamp duty and registration charges

- Book an SRO appointment

- Correct errors if flagged

- Check slip generation and verification

- Complete e-KYC and Aadhaar-based fingerprint verification

How to Pay Stamp Duty Online in Telangana

Stamp duty can be paid online using:

- Debit or credit card

- Net banking

- NEFT

Users must generate an e-challan, save the challan number, and submit the printed copy at the SRO during registration.

Telangana Land Registration Mobile App

The T-Registration mobile app allows users to:

- Pay registration fees

- Track payment status

- Download receipts

This option offers convenience and saves time by avoiding repeated visits.

Support and Contact Details

- Toll-Free Number: 1800 599 4788

- Email: grievance-igrs@igrs.telangana.gov.in

- WhatsApp: 91212 20272

Conclusion

The land registration process in Telangana 2026 is structured, digital-first, and user-friendly. With online document upload, digital payments, and improved verification systems, property registration has become more efficient and transparent.

Buyers and sellers benefit from reduced processing time, accurate records, and simplified procedures. For updated property guides and verified listings, visit openplot.

| Also read Importance of Partition Deed in Property Division A partition deed is a legal document executed during the division of joint property. It describes the specific terms of partition and includes details of how the property will be divided between the parties involved. Lease Deed: Things to Know Before Leasing a property If a property is used by someone other than the original owner, the property is said to be rented or leased. Renting usually involves a short-term contract. However, leasing is generally subject to certain terms specified in the contract. Tips for Buying Property Below Market Value Property value is determined keeping in mind the circle rate or market value. If you find a property priced below market value, should you go for it? Although attractive due to its financial aspect, this deal may have some risks. |

Frequently Asked Questions

Q. How can I check my Telangana land registration?

A. You can check the TS official website.

- Visit the Telangana official website and select the ‘Registered Document Details’ option.

- You need to enter details like District, Sub-Registrar Office (SRO), Book Type, Registration Year, and Document Number.

- Submit or you can reset the information accordingly.

Q. How to get Land Registration documents online in TS?

A. On the Telangana official registration website, click on the link document option and proceed to get the property registration documents online.

Q. How much is the fee for Registering a will in Telangana?

A. A flat fee of Rs.1,000 is charged for registering a will.